E-mini Dow Futures - Maintain Long Positions

rhboskres

Publish date: Thu, 27 Jun 2019, 05:17 PM

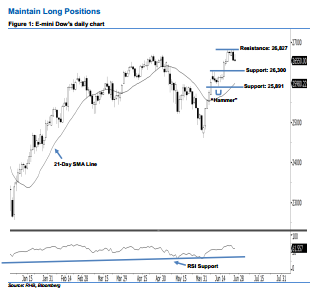

Stay long. The E-mini Dow ended lower to form a “Doji” candle yesterday. It settled at 26,550 pts, after oscillating between a high of 26,703 pts and low of 26,509 pts. However, 25-26 Jun’s candles can be interpreted as a result of profit taking activities following recent gains. From a technical viewpoint, the 21-day SMA line is still edging upwards, suggesting that the upward momentum is not over yet. Overall, we think market sentiment would stay positive, as long as the previously indicated 26,300-pt support is not violated at the closing.

As seen in the chart, we are eyeing the immediate support at 26,300 pts, ie near the midpoint of 18 Jun’s long white candle. If this level is taken out, look to 25,891 pts – ie the low of 13 Jun’s “Hammer” pattern – as the next support. To the upside, the immediate resistance is maintained at 26,827 pts, which was 25 Jun’s high. The next resistance would likely be at the 26,966-pt record high.

Hence, we advise traders to maintain long positions, since we initially recommended initiating long above the 25,437-pt level on 7 Jun. In the meantime, a trailing-stop can be set below the 26,300-pt mark in order to lock in part of the gains.

Source: RHB Securities Research - 27 Jun 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024