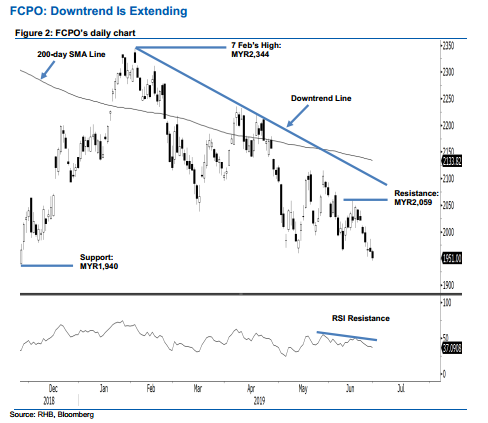

FCPO - Downtrend Is Extending

rhboskres

Publish date: Mon, 01 Jul 2019, 10:42 AM

Initiate short positions as the downtrend is extending. The FCPO formed a black candle to settle MYR12 weaker at MYR1,951. The session’s low and high were registered at MYR1,946 and MYR1,966. The negative session also crossed the MYR1,960 trailing-stop for our previous long positions. This implies the counter-trend rebound phase that we expected was narrower than anticipated, and has been completed. As such, there is a higher chance that the commodity is resuming its downtrend that started from the high of MYR2,344 on 7 Feb. Hence, we switch our trading bias to negative.

Our previous long positions initiated at MYR2,034 – the closing level of 17 Jun – were closed out at MYR1,960 in the latest session. On the expectation that the downtrend is resuming, we initiate short positions at the latest closing level. To manage risks, a stop-loss can be placed above MYR2,059.

The immediate support is retained at MYR1,940, the low of 27 Nov 2018. The second support may emerge at MYR1,900 threshold. Towards the upside, the immediate resistance is set at MYR2,000, the next round figure. This is followed by MYR2,059, the high of 18 Jun.

Source: RHB Securities Research - 1 Jul 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024