WTI Crude Futures - Testing Immediate Resistance

rhboskres

Publish date: Tue, 02 Jul 2019, 10:16 AM

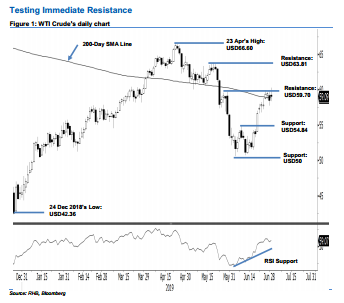

Maintain long positions as the rebound is still showing signs of progress. The black gold performed positively – at one point, it tested the immediate resistance of USD59.70. The session’s low and high were recorded at USD58.34 and USD60.28, before ending at USD59.09, indicating a gain of USD0.62. Overall, the positive session indicated that the commodity’s rebound that started from the area near the USD50 support is still in the process of developing, despite not being able to settle above the said immediate resistance. Hence, we keep to our positive trading bias.

As the commodity’s price actions around the 200-day SMA line is still encouraging, we continue to recommend traders stay in long positions. These were initiated at USD56.56, or the closing level of 20 Jun. For risk management purposes, a stop-loss can now be placed at the breakeven level.

Immediate support is set at USD54.84, which was the high of 10 Jun. This is followed by USD50, a round figure. On the other hand, the overhead resistance is set at USD59.70, ie the high of 30 May. This is followed by USD63.81, which was the high of 20 May.

Source: RHB Securities Research - 2 Jul 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024