E-mini Dow Futures - Bullish Trend Remains Intact

rhboskres

Publish date: Tue, 02 Jul 2019, 10:22 AM

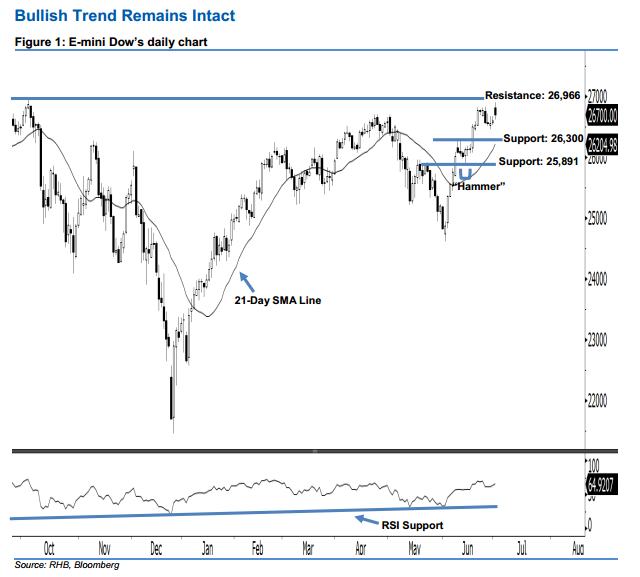

Stay long while setting a trailing-stop below the 26,300-pt support. The E-mini Dow ended higher to form a black candle last night. It gained 107 pts to close at 26,700 pts – off its high of 26,896 pts and low of 26,609 pts. From a technical perspective, we think the upside swing is likely to continue, as the index has marked a higher close above the rising 21-day SMA line. Given that the 14-day RSI indicator is now rising higher without being overbought, this implies that the rebound, which started from 13 Jun’s “Hammer” pattern, may carry on. Overall, we remain upbeat on the E-mini Dow’s outlook.

Based on the daily chart, the immediate support is seen at 26,300 pts – this is situated near the midpoint of 18 Jun’s long white candle. The next support will likely be at 25,891 pts, which was the low of 13 Jun’s “Hammer” pattern. Towards the upside, the near-term resistance is now anticipated at the 26,966-pt historical high. This is followed by the 27,000-pt psychological spot.

Therefore, we advise traders to stay long, following our recommendation of initiating long above the 25,437-pt level on 7 Jun. A trailing-stop can be set below the 26,300-pt threshold to secure part of the profits.

Source: RHB Securities Research - 2 Jul 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024