E-mini Dow Futures - Forms “Long Black Day” Candle

rhboskres

Publish date: Tue, 06 Aug 2019, 02:38 PM

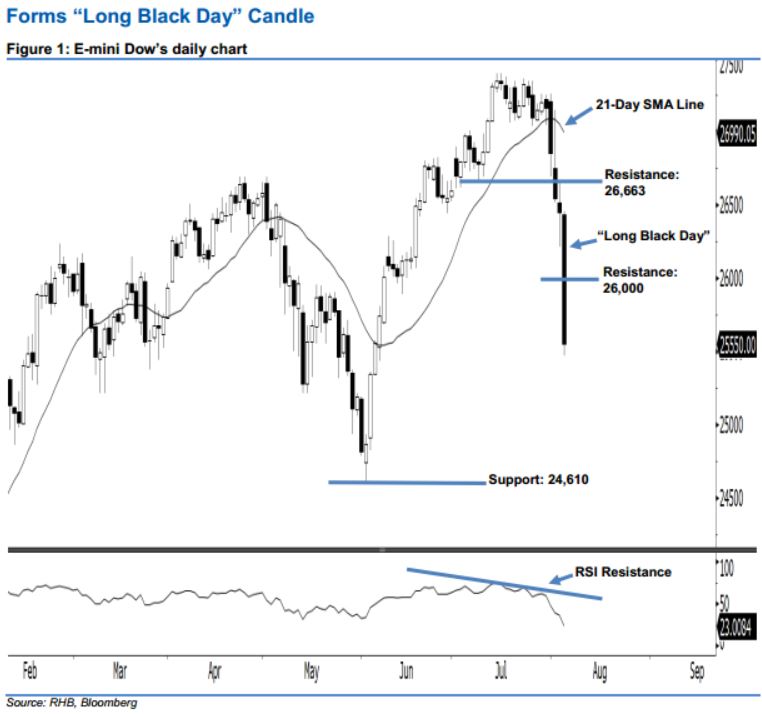

Stay short, with a new trailing-stop set above the 26,000-pt level. Selling momentum in the E-mini Dow continued as expected. A “Long Black Day” candlestick was formed last night, which pointed towards a continuation of the downside move. It plunged 899 pts to close at 25,550 pts, off the session’s high of 26,460 pts. From a technical viewpoint, investor sentiment is likely to remain bearish in the coming sessions. This is as the E-mini Dow posted a fifth consecutive black candle and breached below the 25,891-pt support mentioned previously. Overall, we keep our bearish view on the index’s outlook.

Based on the daily chart, the immediate resistance is now seen at the 26,000-pt round figure, also situated near the midpoint of 5 Aug’s “Long Black Day” candle. The next resistance is anticipated at 26,663 pts, ie 2 Aug’s high. To the upside, we now anticipate the near-term support at the 25,000-pt psychological mark. This is followed by 24,610 pts, obtained from the previous low of 3 Jun.

Recall that on 5 Aug, we initially recommended that traders initiate short positions below the 26,663-pt level. We continue to advise maintaining short positions for now, while setting a new trailing-stop above the 26,000-pt threshold. This is in order to secure part of the gains.

Source: RHB Securities Research - 6 Aug 2019