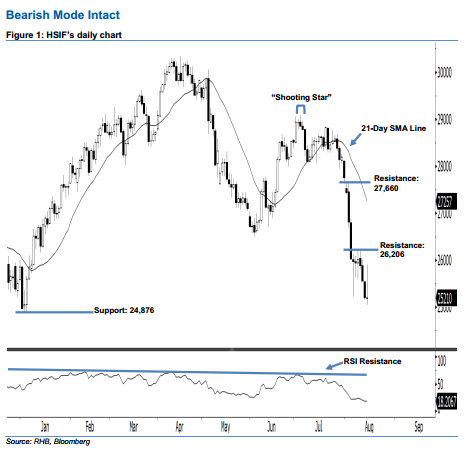

Hang Seng Index Futures - Bearish Mode Intact

rhboskres

Publish date: Thu, 15 Aug 2019, 04:51 PM

Stay short, with a new trailing-stop set above the 26,206-pt level. The HSIF formed a “Doji” candle with a long upper shadow yesterday. It rose to a high of 25,905 pts during the intraday session, before ending at 25,210 pts for the day. From a technical viewpoint, it is not surprising that sellers may be taking a pause following the recent plunge. Yesterday’s long upper shadow of the candle illustrated that the market had rejected higher price levels, reflecting the downward pressure is strong. This also indicated that the market outlook was still bearish.

Based on the daily chart, the immediate resistance level is now seen at 26,206 pts, determined from the high of 9 Aug. Meanwhile, the next resistance is anticipated at 27,660 pts, ie 2 Aug’s high. Towards the downside, we maintain the near-term support level at the 25,000-pt psychological mark. This is followed by 24,876 pts, which was the previous low of 3 Jan.

Recall that on 1 Aug, we initially recommended traders to initiate short positions below the 28,109-pt level. We continue to advise them to stay short for now, while setting a new trailing-stop above the 26,206-pt threshold. This is in order to lock in a larger part of the profits.

Source: RHB Securities Research - 15 Aug 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024