Hang Seng Index Futures - Market Correction Pause

rhboskres

Publish date: Fri, 16 Aug 2019, 05:13 PM

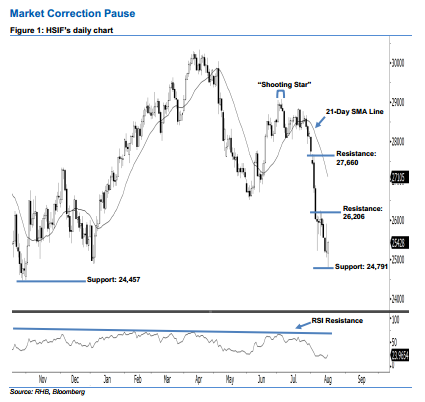

Bearish outlook stays intact; stay short. The HSIF formed a white candle yesterday. It closed at 25,428 pts, after oscillating between a high of 25,475 pts and low of 24,791 pts. However, the bearish sentiment stays intact. This is as yesterday’s white candle can only be viewed as a result of bargain-hunting activities after the recent sell-off. Given that the HSIF is still trading below the declining 21-day SMA line and the 26,206-pt resistance mentioned previously, this implies that the downside swing that began from 4 Jul’s “Shooting Star” pattern may carry on. Overall, we keep our bearish view on the HSIF’s outlook.

Currently, we are eyeing the immediate resistance level at 26,206 pts, which was the high of 9 Aug. If a breakout arises, the next resistance is maintained at 27,660 pts, obtained from the high of 2 Aug. To the downside, the immediate support level is now seen at 24,791 pts, ie the low of 15 Aug. Meanwhile, the next support is seen at 24,457 pts, determined from the previous low of 29 Oct 2018.

Therefore, we advise traders to stay short, following our recommendation of initiating short below the 28,109-pt level on 1 Aug. A trailing-stop can be set above the 26,206-pt mark in order to secure part of the gains.

Source: RHB Securities Research - 16 Aug 2019