E-mini Dow Futures - Rebound Likely to Persist

rhboskres

Publish date: Tue, 27 Aug 2019, 01:59 PM

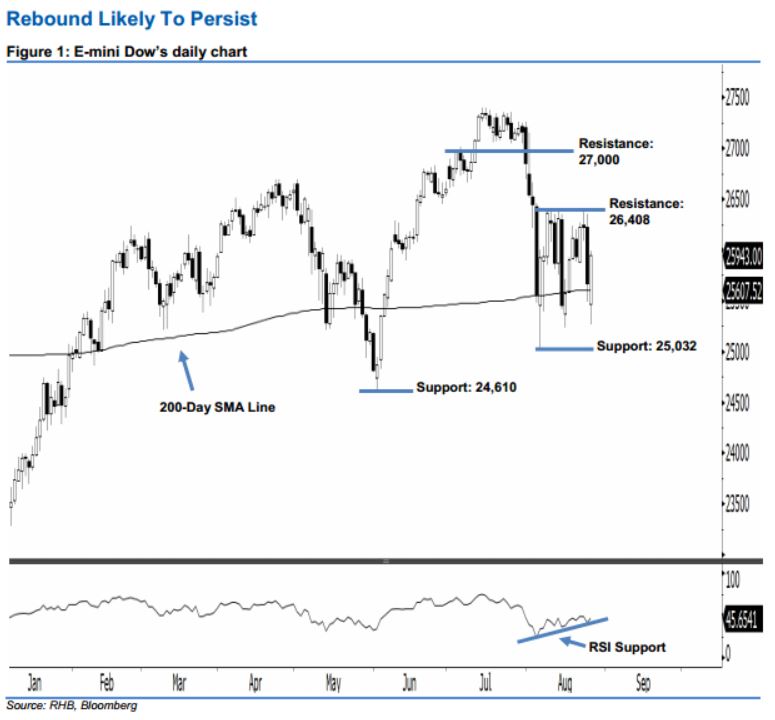

Stay long, with a stop-loss set below the 25,032-pt support. The E-mini Dow formed a white candle last night. It gained 273 pts to close at 25,943 pts, off its high of 25,986 pts and low of 25,266 pts. On a technical basis, as the index has marked a higher close vis-à-vis the previous session – and remained above the 200-day SMA line – this points to the buying momentum not being over yet. Yesterday’s higher close can also be viewed as a continuation of the buyers extending the rebound from 6 Aug’s white candle. Overall, we stay positive on the Emini Dow’s outlook.

According to the daily chart, we are eyeing the immediate support level at 25,032 pts, determined from the previous low of 6 Aug. The next support would likely be at 24,610 pts, ie the low of 3 Jun. On the other hand, the immediate resistance level is seen at 26,408 pts, obtained from 13 Aug’s high. If a breakout arises, the next resistance is maintained at the 27,000-pt psychological spot.

Thus, we advise traders to stay long, since we had originally recommended initiating long above the 26,035-pt level on 9 Aug. In the meantime, a stop-loss can be set below the 25,032-pt threshold in order to minimise the downside risk.

Source: RHB Securities Research - 27 Aug 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024