E-mini Dow Futures - Still Positive

rhboskres

Publish date: Wed, 28 Aug 2019, 11:46 AM

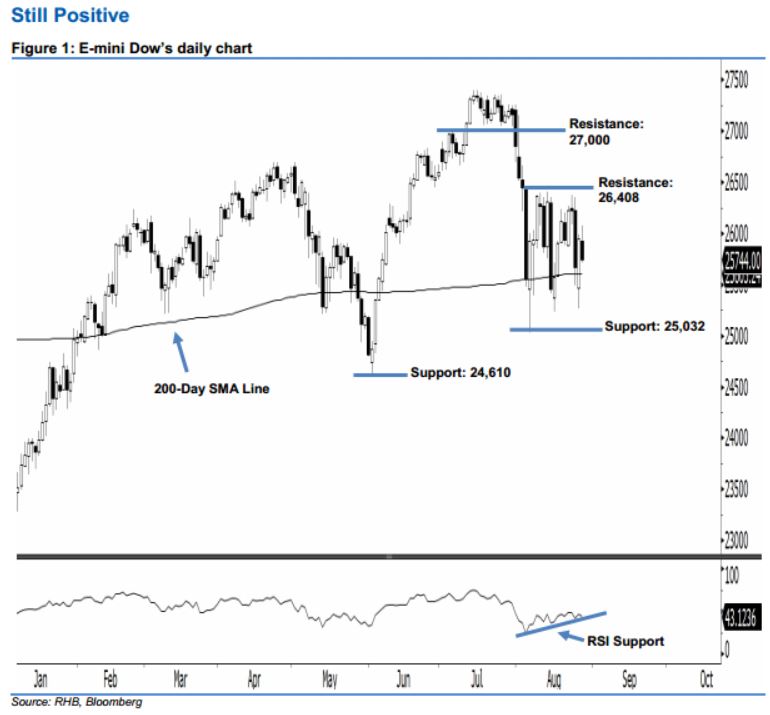

Maintain long positions. The E-mini Dow ended lower to form a black candle last night. It declined 199 pts to close at 25,744 pts, off its high of 26,069 pts and low of 25,711 pts. However, the selling momentum is considered weak, as the index is still trading above the 200-day SMA line and the previously-indicated 25,032-pt support. Again, as long as the E-mini Dow fails to erase the gains from 6 Aug’s white candle, we believe the buyers still have control of the market. Overall, we remain positive about the index’s outlook.

As seen in the chart, we anticipate the immediate support level at 25,032 pts, ie the previous low of 6 Aug. If a decisive breakdown arises, look to 24,610 pts – determined from the low of 3 Jun – as the next support. Towards the upside, the immediate resistance level is situated at 26,408 pts, ie the high of 13 Aug. The next resistance would likely be at the 27,000-pt psychological mark.

Hence, we advise traders to stay long, given that we initially recommended initiating long above the 26,035-pt level on 9 Aug. At the same time, a stop-loss is advisable to be set below the 25,032-pt threshold in order to limit the downside risk.

Source: RHB Securities Research - 28 Aug 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024