Hang Seng Index Futures - Rebound Stays Intact

rhboskres

Publish date: Wed, 28 Aug 2019, 11:47 AM

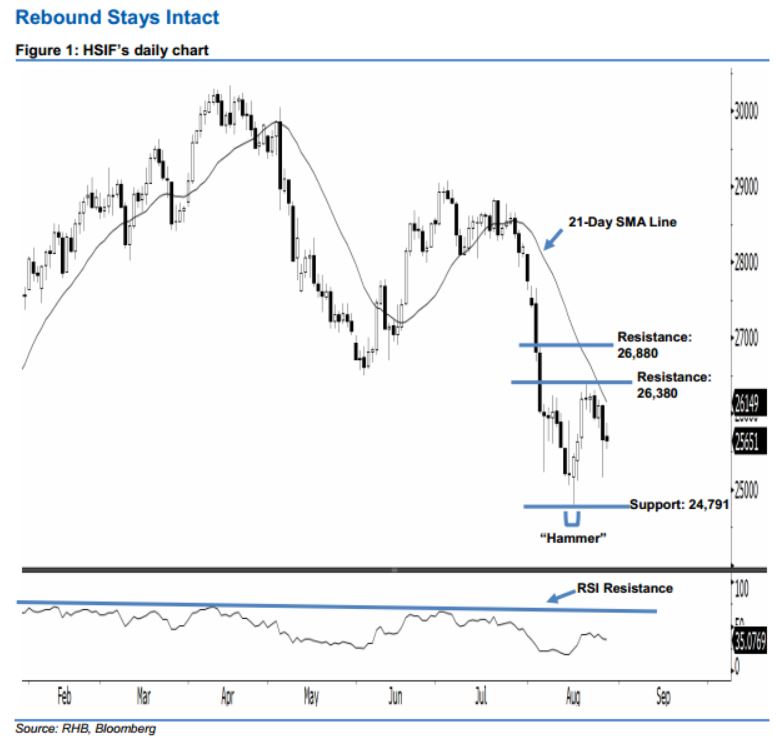

Stay long, with a stop-loss set below the 24,791-pt support. The HSIF formed another black candle yesterday. It settled at 25,651 pts, after hovering between a high of 25,878 pts and low of 25,533 pts throughout the day. Still, on a technical basis, yesterday’s black candle can be viewed as market pullback after the recent rebound. We think the bulls may continue to control the market, given that the index did not negate the bullishness of 15 Aug’s “Hammer” pattern. Overall, we keep our positive view on the HSIF’s outlook.

Based on the daily chart, the immediate support level is maintained at the 25,000-pt round figure. The crucial support is seen at 24,791 pts, determined from the low of 15 Aug’s “Hammer” pattern. To the upside, the immediate resistance level is seen at 26,380 pts, which was the high of 20 Aug. Meanwhile, the next resistance would likely be at 26,880 pts, ie the high of 5 Aug’s long black candle.

Thus, we advise traders to maintain long positions, since we initially recommended initiating long above the 26,000- pt level on 21 Aug. A stop-loss can be set below the 24,791-pt threshold in order to minimise the downside risk.

Source: RHB Securities Research - 28 Aug 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024