FCPO - Technical Picture Remains Constructive

rhboskres

Publish date: Thu, 29 Aug 2019, 09:54 AM

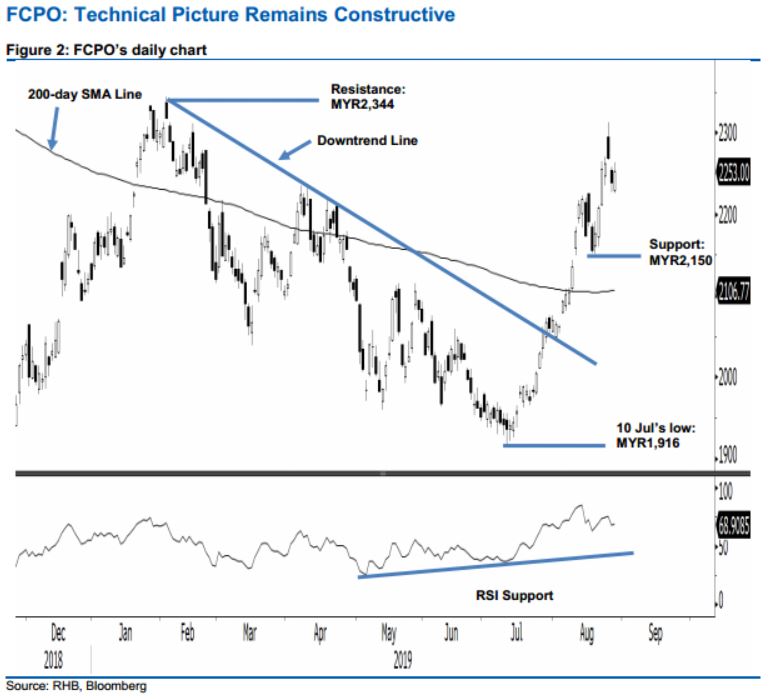

Maintain long positions as the upward move stays intact. The latest session witnessed the commodity advancing MYR14 to settle at MYR2,253. The low and high were posted at MYR2,225 and MYR2,264. Price actions over the past three sessions indicate a minor consolidation is developing around the MRY2,300 round figure level. This is deemed as healthy to correct the previous upward move that recently hit an overbought level. As the commodity is not showing signs of developing a deeper retracement, we keep to our positive trading bias.

On the basis that the bulls are still showing firm control over the price trend, traders are advised to remain in long positions. We initiated these at MYR2,256, the closing level of 22 Aug. For risk management purposes, a stop-loss can be placed below the MYR2,150 level.

The immediate support is set at MYR2,150, the low of 20 Aug. This is followed by MYR2,100, near the 200-day SMA line. Towards the upside, the immediate resistance is set at MYR2,344, the high of 7 Feb. This is followed by MYR2,400, the next round figure.

Source: RHB Securities Research - 29 Aug 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024