Hang Seng Index Futures - Still Above the 24,791-Pt Support

rhboskres

Publish date: Fri, 30 Aug 2019, 10:09 AM

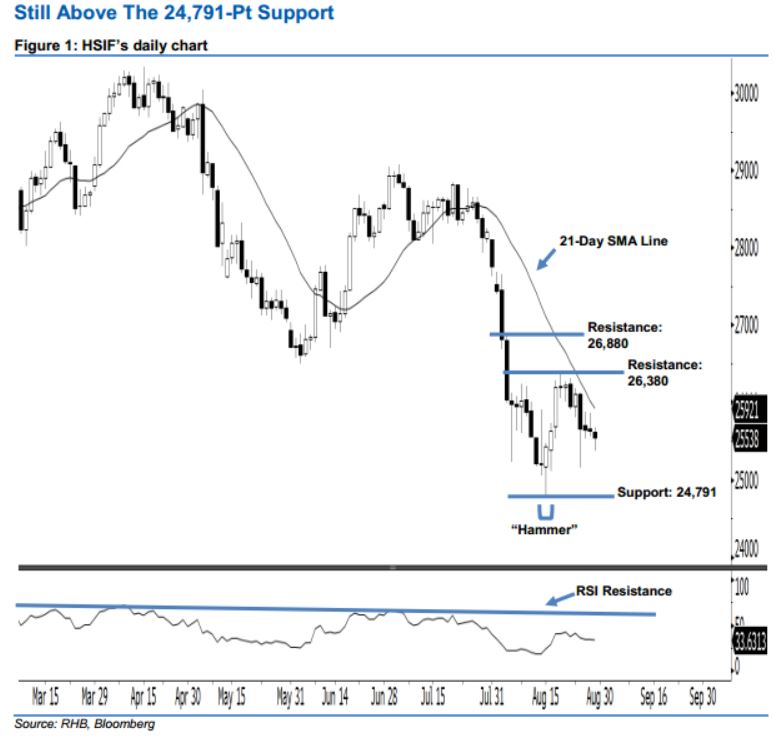

Stay long while setting a stop-loss below the 24,791-pt support. The HSIF formed another black candle yesterday. It settled at 25,538 pts, off its high of 25,681 pts and low of 25,377 pts. However, the appearance of 26- 29 Aug’s black candles indicates that the buyers may be taking a breather following the recent rebound. From a technical viewpoint, the positive sentiment stays intact. This is as long as the index does not break below the 24,791-pt support mentioned since two weeks ago. Overall, we think the rebound – which began from 15 Aug’s “Hammer” pattern – may persist.

Based on the daily chart, the immediate support level is seen at the 25,000-pt round figure. The next support will likely be at 24,791 pts, ie the low of 15 Aug’s “Hammer” pattern. Towards the upside, the immediate resistance level is situated at 26,380 pts, which was 20 Aug’s high. Meanwhile, the next resistance is anticipated at 26,880 pts, defined from the high of 5 Aug’s long black candle.

Consequently, we advise traders to stay long, following our recommendation of initiating long above the 26,000-pt level on 21 Aug. A stop-loss can be set below the 24,791-pt threshold to minimise the downside risk.

Source: RHB Securities Research - 30 Aug 2019