WTI Crude Futures - Rebound May Still be Able to Extend

rhboskres

Publish date: Tue, 03 Sep 2019, 12:01 PM

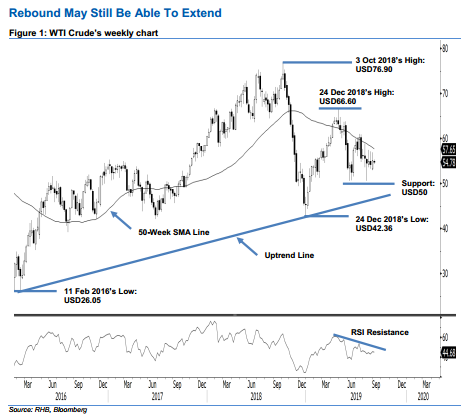

Long-term technical picture still positive. We take a look at the black gold’s long-term price trend in today’s publication. Overall, the commodity’s upward move that started from the low of USD26.05 on 11 Feb 2016 is still in place. This long-term positive bias would stay in place provided the uptrend line (as drawn on the chart) is not beached. Additionally, in the short term, the commodity is seen to be in a rebound phase after it recently came in near to test the immediate support of USD50 - we are expecting the 50-Week SMA line to be tested by the bulls. Hence, we keep to our positive trading bias.

As the bulls are still having an upper hand over the short-term rebound, we continue to recommend traders stay in long positions. We initiated these at USD57.10, or the closing level of 13 Aug. For risk-management purposes, a stop-loss can now be placed at the USD50 mark.

Immediate support is pegged at USD50, a round figure. This is followed by the USD45 threshold. Meanwhile, the immediate resistance is set at USD58.82, which was the high of 31 Jul. This is followed by the USD60.94 mark, or the high of 1 Jul.

Source: RHB Securities Research - 3 Sept 2019