COMEX Gold - Positive Tone Stays

rhboskres

Publish date: Wed, 04 Sep 2019, 11:46 AM

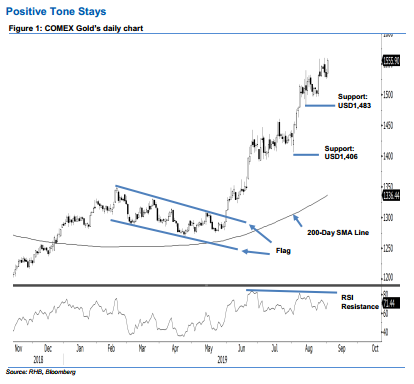

Maintain long positions as the upward move is not showing signs of exhaustion. The COMEX Gold advanced USD26.50 to close at USD1,555.90 – slightly above the previous immediate resistance of USD1,550. Trading range was between USD1,528 and USD1,558.90. Overall, the commodity’s multi-quarters upward move is still showing strong posture ie no signs of price exhaustion, despite reaching an overbought RSI reading recently. We continue to regard the price actions over the recent session as mere shallow consolidation phase. Hence, we keep to our positive trading bias.

In the absence of adverse price actions that could indicate a change in the bias, we retain our recommendation for traders to stay in long positions. We opened these positions at USD1,333.60, which was the closing level for 5 Jun. For risk-management purposes, a stop-loss can now be placed below the USD1,450 mark.

Immediate support is revised to USD1,483, the low of 13 Aug. This is followed by USD1,406, or near the low of 1 Aug. Meanwhile, the immediate resistance is now expected at the USD1,600 threshold, followed by USD1,650.

Source: RHB Securities Research - 4 Sept 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024