Hang Seng Index Futures - “Long White Day” Candle Emerges

rhboskres

Publish date: Thu, 05 Sep 2019, 04:56 PM

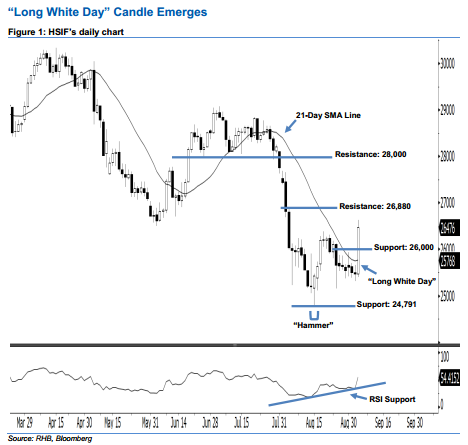

The buying momentum may have returned – stay long. The HSIF formed a “Long White Day” candle yesterday, indicating that the buying momentum could be strong. The index surged 1,008 pts to settle at 26,476 pts. From a technical perspective, the upside move is likely to continue, as it has climbed above the 21-day SMA line and is hitting the 1-month high. We view yesterday’s candle as a continuation of the buyers extending the rebound from 15 Aug’s “Hammer” pattern. Overall, we keep our bullish view on the HSIF’s outlook.

Based on the daily chart, the immediate support level is now anticipated at the 26,000-pt psychological spot, set near the midpoint of 4 Sep’s “Long White Day” candle as well. The crucial support is maintained at 24,791 pts, ie the low of 15 Aug’s “Hammer” pattern. Towards the upside, we are eyeing the immediate resistance level at 26,880 pts, defined from 5 Aug’s high. Meanwhile, the next resistance is seen at the 28,000-pt round figure.

Therefore, we advise traders to stay long, in line with our initial recommendation to have long positions above the 26,000-pt level on 21 Aug. A stop-loss can be set below the 24,791-pt threshold to limit the risk per trade.

Source: RHB Securities Research - 5 Sept 2019