E-mini Dow Futures - Market Recovery Likely to Continue

rhboskres

Publish date: Thu, 05 Sep 2019, 04:57 PM

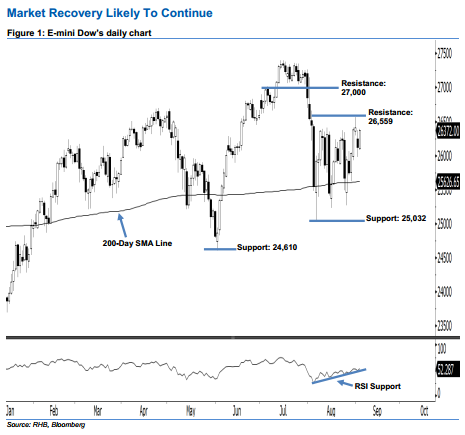

Trading above the 200-day SMA line; stay long. The E-mini Dow formed a white candle last night. It gained 250 pts to close at 26,372 pts after oscillating between a high of 26,388 pts and low of 26,083 pts. Based on the current technical landscape, the market sentiment remains bullish, as the index has recouped the previous day’s losses and marked a higher close above the 200-day SMA line. Given that the 14-day RSI Indicator has recovered to a more positive reading at 52.28 pts, there is the possibility that the uptrend should persist. Overall, we remain bullish on the E-mini Dow’s outlook.

Currently, the immediate support level is maintained at 25,032 pts, ie the low of 6 Aug. The next support will likely be at 24,610 pts, which was the previous low of 3 Jun. Towards the upside, the immediate resistance level is anticipated at 26,559 pts – this was determined from 30 Aug’s high. The next resistance is situated at the 27,000- pt psychological mark.

Hence, we advise traders to maintain long positions, since we initially recommended initiating long above the 26,035-pt level on 9 Aug. In the meantime, a stop loss can be set below the 25,032-pt mark to limit the downside risk.

Source: RHB Securities Research - 5 Sept 2019