COMEX Gold - Tightening Up Trailing-Stop

rhboskres

Publish date: Fri, 06 Sep 2019, 04:45 PM

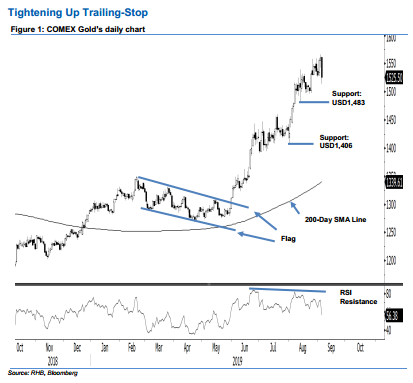

Maintain long positions while moving up trailing-stop. The COMEX Gold formed a black candle, which at the closing sent it back by USD34.90 to USD1,525.50. Trading range was wide, between USD1,514.30 and USD1,561.90. The relatively strong adverse price action can be seen as a possible early sign that the commodity is at the risk of entering a correction phase, after it experienced a relatively sharp multi-month upward move. However, to confirm this, the latest session’s low has to be crossed decisively. Until this happens, we keep to our positive trading bias.

Pending confirmation that the upward move has reached an interim top, we retain our recommendation for traders to stay in long positions. We opened these positions at USD1,333.60, which was the closing level for 5 Jun. For risk-management purposes, a stop loss can now be placed below the USD1,514.30 mark, the latest session’s low.

We are keeping the immediate support at USD1,483, or the low of 13 Aug. This is followed by the USD1,406 mark, which was near the low of 1 Aug. Moving up, the immediate resistance is now expected at the USD1,600 threshold, followed by the USD1,650 level.

Source: RHB Securities Research - 6 Sept 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024