WTI Crude Futures - Still Unable to Cross the Wall

rhboskres

Publish date: Fri, 06 Sep 2019, 04:47 PM

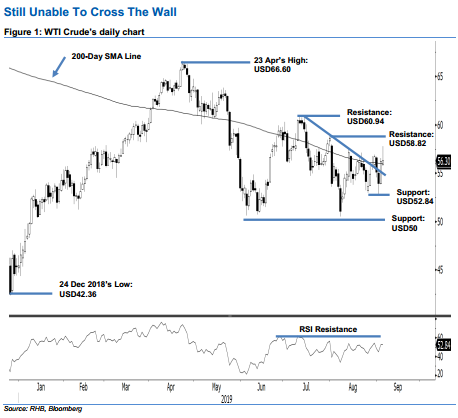

Maintain long positions. The latest session witnessed the WTI Crude briefly crossing the resistance zone, consisting of the 200-day SMA and the downtrend lines (as drawn on the chart). However, the bulls failed to maintain this positive momentum, at the closing it settled marginally higher by USD0.04 at USD56.30. The low and high were posted at USD55.75 and USD57.76. While the failed breakout attempt is suggesting the bulls are still not able to signal an extension of the commodity’s rebound, there were also no clear price rejection signals from the resistance zone that could mark an end to the said rebound. Maintain our positive trading bias.

As the rebound phase is still considered as valid, we continue to recommend traders stay in long positions. We initiated these at USD57.10, or the closing level of 13 Aug. For risk-management purposes, a stop loss can now be placed below the USD52.84 mark.

Immediate support is eyed at USD52.84, ie the low of 3 Sep. This is followed by the USD50 round figure. Meanwhile, the immediate resistance is set at USD58.82, which was the high of 31 Jul. This is followed by the USD60.94 mark, or the high of 1 Jul.

Source: RHB Securities Research - 6 Sept 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024