Hang Seng Index Futures - The Rally Continues

rhboskres

Publish date: Thu, 12 Sep 2019, 04:49 PM

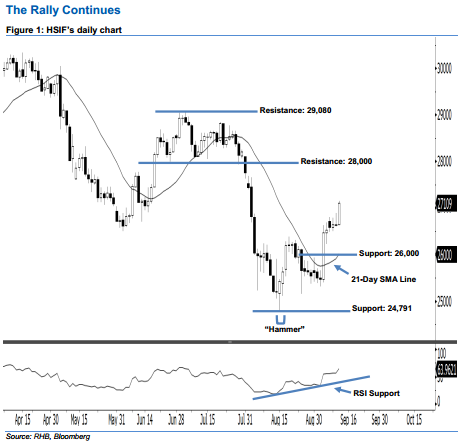

Stay long while setting a new trailing-stop below the 26,000-pt support. The HSIF formed a long white candle yesterday, indicating that the buying momentum could be strong. It surged 481 pts to close at 27,109 pts. As the index has successfully taken out the 26,880-pt resistance mentioned previously, this can be viewed as the bulls extending their upward momentum. In view of the fact that the HSIF has marked its highest close in more than a month, this is an indication that the rebound that started off 15 Aug’s “Hammer” pattern may persist.

Based on the daily chart, the immediate support level is maintained at the 26,000-pt round figure – this is also set near the midpoint of 4 Sep’s long white candle. If this level is taken out, the next support is seen at 24,791 pts, which was the low of 15 Aug’s “Hammer” pattern. Towards the upside, we are eyeing the immediate resistance at the 28,000-pt psychological mark. The next resistance should likely be at 29,080 pts, ie the previous high of 4 Jul.

Therefore, we advise traders to stay long, in line with our initial recommendation on 21 Aug to have long positions above the 26,000-pt level. For now, a new trailing-stop can be set below the 26,000-pt mark as well in order to limit the downside risk.

Source: RHB Securities Research - 12 Sept 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024