E-mini Dow Futures - Sixth Consecutive White Candle

rhboskres

Publish date: Thu, 12 Sep 2019, 04:56 PM

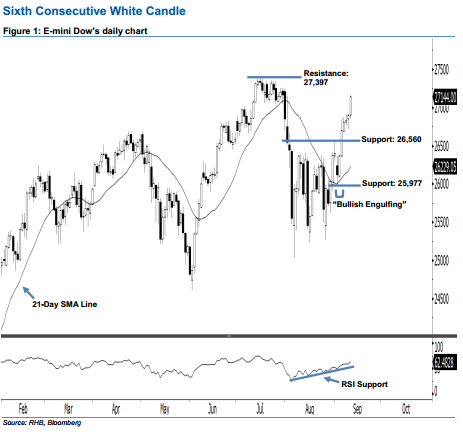

Stay long, with a new trailing-stop set below the 26,560-pt level. The E-mini Dow‘s upside strength continued as expected, after it ended higher to form a long white candle last night. It gained 250 pts to close at 27,144 pts, off the session’s low of 26,849 pts. As the index has posted a sixth consecutive white candle and taken out the 27,000- pt resistance, this can be viewed as the buyers extending their buying momentum. Yesterday’s long white candle can also be viewed as the bulls extending the rebound from 4 Sep’s “Bullish Engulfing” pattern. Overall, we remain upbeat on the E-mini Dow’s outlook.

As seen in the chart, the immediate support level is now anticipated at 26,560 pts – this is set near the midpoint of 5 Sep’s long white candle. The next support is maintained at 25,977 pts, which was the low of 4 Sep’s “Bullish Engulfing” pattern. To the upside, the near-term resistance level is seen at the 27,397-pt record high. This is followed by the 28,000-pt psychological mark.

To recap, we initially recommended traders to initiate long positions above the 26,035-pt level on 9 Aug. We continue to advise them to stay long for now, while setting a new trailing-stop below the 26,560-pt threshold to lock in part of the profits.

Source: RHB Securities Research - 12 Sept 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024