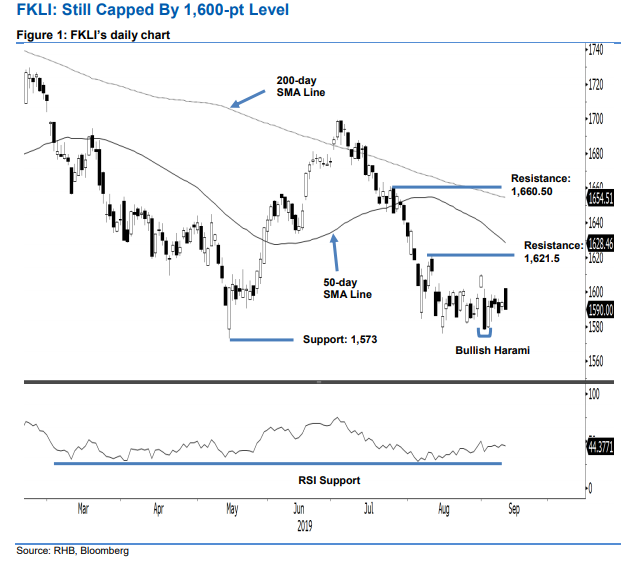

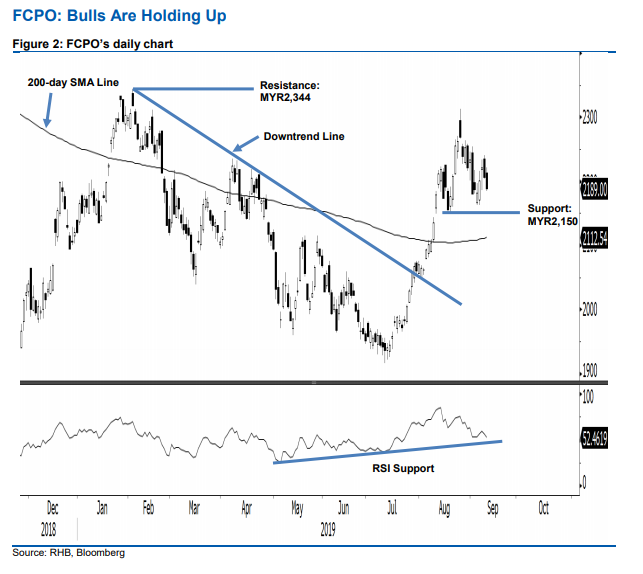

FKLI & FCPO - Still Capped By 1,600-pt Level & Bulls Are Holding Up

rhboskres

Publish date: Fri, 13 Sep 2019, 05:21 PM

Maintain short positions, as the index remains shy of the 1,600-pt mark. The FKLI failed to hold on to its earlier session’s positive tone yesterday. At one point, it tested the 1,600-pt level with an intraday high of 1,602 pts, before sliding to close at 1,590 pts, marking a 4-pt decline. The weak session means there is still no price confirmation to indicate the index’s weak trend (which resumed on 2 Jul after a failed attempt to cross 1,700-pt level) has reached an interim low – which would enable a stronger rebound to develop. Until the bulls manage to cross the 1,600-pt level decisively, we keep to our negative trading bias. With no price confirmation that the bulls are ready to stage a stronger rebound, traders are recommended to stay in short positions. We initiated these at 1,668 pts, or the closing level of 12 Jul. To manage risks, a stop-loss can now be placed above the 1,600-pt mark. Immediate support is still expected to emerge at 1,573 pts, ie the low of 14 May. This is followed by the 1,550-pt mark. Meanwhile, we maintain the immediate resistance target at 1,621.5 pts, or the high of 9 Aug. This is followed by 1,660.5 pts, ie the high of 24 July.

Maintain long positions as the rally may still able to extend. The FCPO formed a black candle to settle MYR17 lower at MYR2,189. Trading ranged between MYR2,185 and MYR2,221. While the commodity has been trading on a soft patch over the latest two sessions, the overall positive trend that started from July has not changed. This bias would stay, provided the low of MYR2,163 on 5-6 Sep (trailing-stop for our ongoing long positions) is not breached towards the downside. As such, we keep to our positive trading bias. Until there are firm signals that indicate the commodity’s upward move has reached an interim top, traders should remain in long positions. We initiated these at MYR2,256, the closing level of 22 Aug. To manage risks, a stop-loss can be placed below the MYR2,163 point. We are keeping the immediate support at MYR2,150, ie the low of 20 Aug. This is followed by MYR2,100, near the 200-day SMA line. Conversely, the immediate resistance is set at MYR2,344, or the high of 7 Feb. This is followed by MYR2,400.

Source: RHB Securities Research - 13 Sept 2019