WTI Crude Futures: A Sharp Spike Session

rhboskres

Publish date: Tue, 17 Sep 2019, 09:10 AM

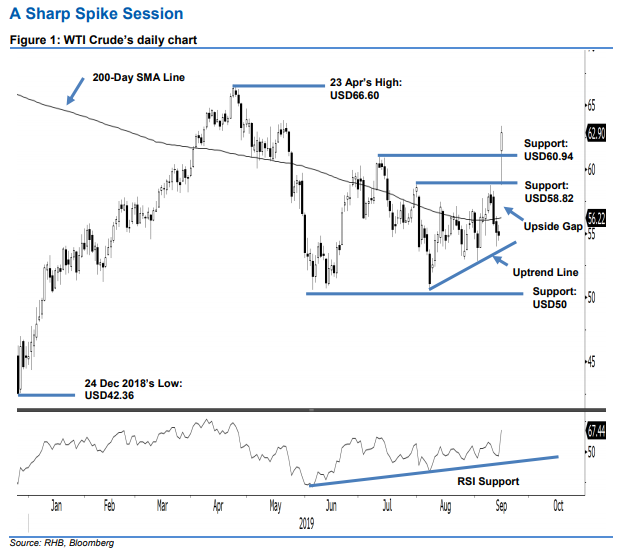

Maintain long positions. The WTI Crude experienced a sharp spike in the latest session. It opened with an “Upside Gap” and at the closing settled USD8.05 higher at USD62.90. The high was posted at USD63.38. The positive session also took out the previous resistance points of USD58.82 and USD60.94, as well as the 200-day SMA line. The positive session came after the commodity came in near to test the uptrend line (as drawn on the chart) that formed since early August in the previous two sessions. The RSI reading is still considered as healthy ie not overbought. Maintain our positive trading bias. As the bulls are back with firmer control, we continue to recommend traders stay in long positions. We initiated these at USD57.10, or the closing level of 13 Aug. For risk-management purposes, a stop loss can now be placed at the breakeven mark. The immediate support target is revised to the USD60.94 mark, or the high of 1 Jul. This is followed by USD58.82, which was the high of 31 Jul. Towards the upside, immediate resistance is set at USD66.60, which was the high of 23 Apr. This is followed by USD70, the next round figure.

Source: RHB Securities Research - 17 Sept 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024