FKLI & FCPO: Negative Bias Stays & Bulls Still In Control

rhboskres

Publish date: Tue, 17 Sep 2019, 09:15 AM

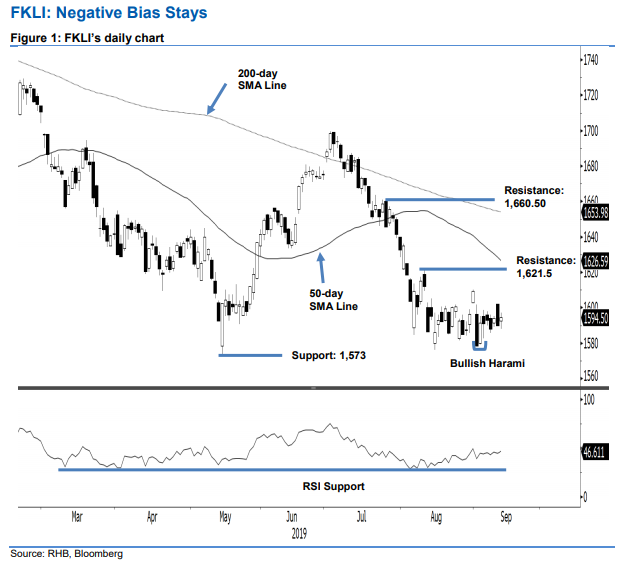

Still no confirmation for a stronger rebound; maintain short positions. The FKLI posted a 4.5 pts gain to settle at 1,594.5 pts. The low and high were recorded at 1,588 pts and 1,597 pts. Despite the appearance of the 4 Sept’s “Bullish Harami” formation near the immediate support of 1,573 pts, there is still no price confirmation to indicate that a stronger rebound is taking place. This implies the index’s weak trend is still firmly in place. Towards the upside, a firm upside breach of the 1,600-pt level is required to confirm the prospects for a stronger rebound. For now, we keep to our negative trading bias. With the bulls still unable to signal firmer control over the price trend, traders are recommended to stay in short positions. We initiated these at 1,668 pts, or the closing level of 12 Jul. To manage risks, a stop-loss can now be placed above the 1,600-pt mark. The immediate support is pegged at 1,573 pts, ie the low of 14 May. This is followed by the 1,550-pt mark. On the other hand, the immediate resistance is eyed at 1,621.5 pts, or the high of 9 Aug. This is followed by 1,660.5 pts, ie the high of 24 Jul.

Maintain long positions. The FCPO reached a low and high of MYR2,172 and MYR2,206 in the latest session, before ending at MYR2,190, indicating a marginal gain of MYR1. The commodity’s upward move that started from July is still considered intact. This bias would remain provided the trailing-stop for our ongoing long positions of MYR2,163 is not triggered. Lending further support to this bias is the fact that the commodity is trading relatively firm above the 200-day SMA line. Additionally, its RSI has reverted to a healthier level – from an overbought condition in August. Hence, we keep to our positive trading bias. As there are no adverse price signals that could indicate the commodity’s upward move has peaked, traders should remain in long positions. We initiated these at MYR2,256, the closing level of 22 Aug. To manage risks, a stop-loss can be placed below the MYR2,163 point. Towards the downside, the immediate support is eyed at MYR2,150, ie the low of 20 Aug. This is followed by MYR2,100, near the 200-day SMA line. Moving up, the immediate resistance is set at MYR2,344, or the high of 7 Feb. This is followed by MYR2,400.

Source: RHB Securities Research - 17 Sept 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024