WTI Crude Futures - Trailing-Stop Holding Up

rhboskres

Publish date: Wed, 18 Sep 2019, 09:59 AM

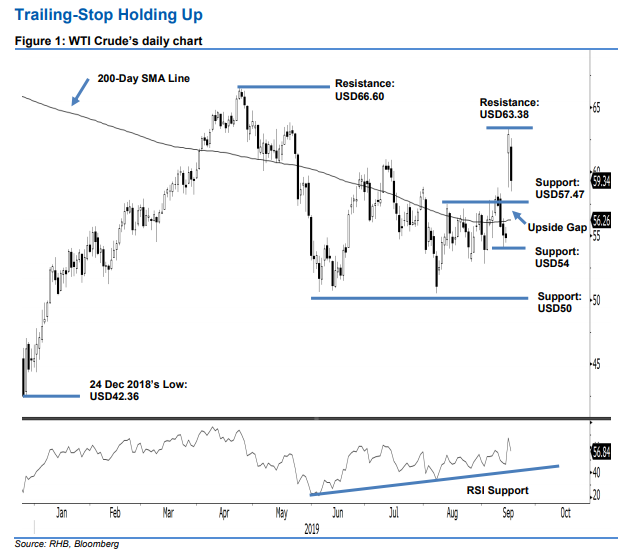

Maintain long positions as the technical picture is still constructive. The WTI Crude experienced a relatively sharp pullback yesterday. This came after the previous session’s spike. At the closing, the commodity shed USD3.56 to settle at USD59.34. Trading range was wide, between USD58.46 and USD62.59. Despite the sharp decline, at this juncture, there is no sufficient technical evidence to signal the commodity’s rebound has reached an end. For now, provided the trailing-stop of USD57.10 for our ongoing long positions is not breached, we would stay with our positive trading bias. As we are not seeing compelling technical evidence to signal the bulls have run out of steam, we continue to recommend traders stay in long positions. We initiated these at USD57.10, or the closing level of 13 Aug. For risk-management purposes, a stop loss can now be placed at the breakeven mark. Immediate support target is revised to USD57.47, which was the high of 13 Aug. This is followed by USD54, the low of 12 Sep. Moving up, immediate resistance is now eyed at USD63.38, the high of 16 Sep. This is to be followed by USD66.60, which was the high of 23 Apr. This is followed by USD70, the next round figure.

Source: RHB Securities Research - 18 Sept 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024