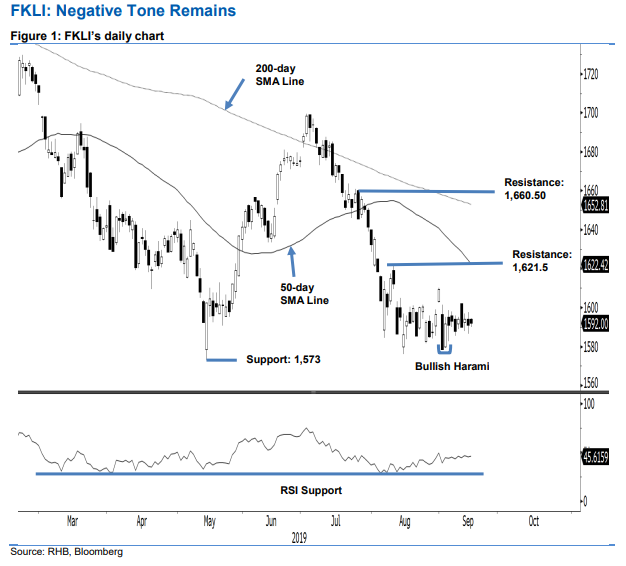

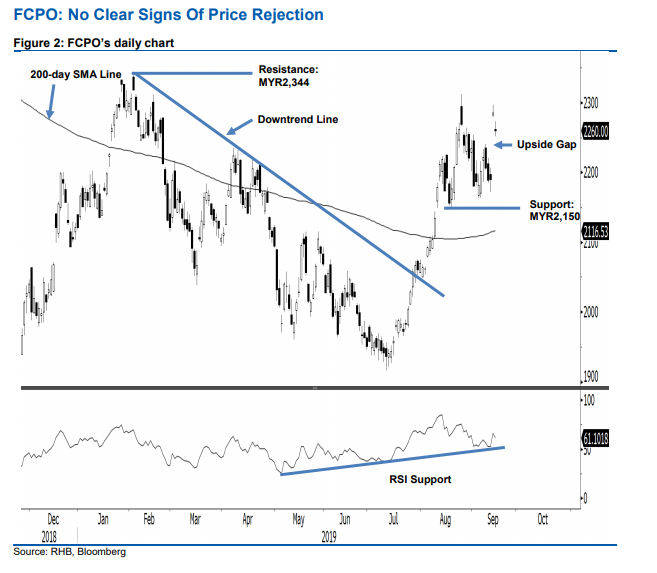

FKLI & FCPO: FKLI: Negative Tone Remains & No Clear Signs Of Price Rejection

rhboskres

Publish date: Thu, 19 Sep 2019, 10:05 AM

Trend remains negative; maintain short positions. The FKLI edged up marginally by 1 pt to settle the latest session at 1,592 pts. Intraday, it reached a low and high of 1,590 pts and 1,594.5 pts. Despite the emergence of the 4 Sept’s “Bullish Harami” formation, the index continued to trade sideways, which has been in development over the past few weeks. This implies that the bulls are still weak. For this to change, the index has to push through the 1,600-pt round figure. For now, we stick to our negative trading bias. With no price confirmation to signal the interim low has been reached, traders are recommended to stay in short positions. We initiated these at 1,668 pts, or the closing level of 12 Jul. To manage risks, a stop-loss can now be placed above the 1,600-pt mark. The immediate support is expected to emerge at 1,573 pts, ie the low of 14 May. This is followed by the 1,550-pt mark. On the other hand, the immediate resistance is eyed at 1,621.5 pts, or the high of 9 Aug. Breaking this may see the market test the 1,660.5-pt mark, ie the high of 24 Jul.

Maintain long positions. The FCPO ended the latest session MYR25 weaker at MYR2,260. This was after it reached a low and high of MYR2,252 and MYR2,273. The weak session set in after the commodity close to test the MYR2,300 round figure in the previous session, which was its second attempt since 26 Aug. At this juncture, there is insufficient evidence to suggest the commodity is experiencing a price rejection from the MYR2,300 mark. As such, we still consider the commodity’s upward move as intact until further adverse price actions take place. Maintain our positive trading bias. On the bias that the upward move may still has legs to extend further, traders are advised to remain in long positions. We initiated these at MYR2,256, the closing level of 22 Aug. To manage risks, a stop-loss can be placed at the breakeven level. The immediate support is pegged at MYR2,150, ie the low of 20 Aug. This is followed by MYR2,100, near the 200-day SMA line. On the other hand, the immediate resistance is set at MYR2,344, or the high of 7 Feb. This is followed by the MYR2,400 level.

Source: RHB Securities Research - 19 Sept 2019