WTI Crude Futures - Trading Above Support

rhboskres

Publish date: Thu, 19 Sep 2019, 05:52 PM

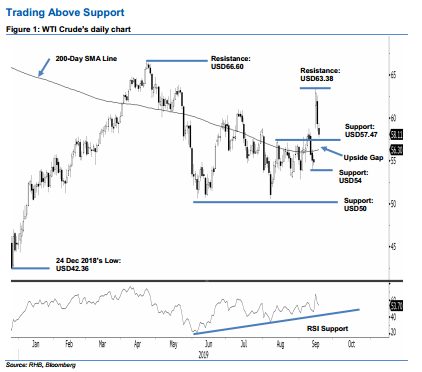

Maintain long positions. The WTI Crude retraced for a second consecutive session, this was after it reached a high of USD63.38 in the previous two sessions. At the closing, the black gold weakened USD1.23 to close at USD58.11. The trading tone was negative as the commodity generally trended lower for the entire session, the high and low were recorded at USD59.43 and USD57.67. While the commodity’s retracement over the latest two sessions has been sharp, the overall positive landscape would remain as long as the trailing-stop of USD57.10 for our ongoing long positions is not breached. Maintain positive trading bias.

On the bias that the upward move may still carry on, we continue to recommend traders stay in long positions. We initiated these at USD57.10, or the closing level of 13 Aug. For risk-management purposes, a stop loss can now be placed at the breakeven mark.

On the downside, immediate support is set at USD57.47, which was the high of 13 Aug. This is followed by USD54, the low of 12 Sep. Conversely, immediate resistance is pegged at USD63.38, the high of 16 Sep. This is to be followed by USD66.60, which was the high of 23 Apr.

Source: RHB Securities Research - 19 Sept 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024