WTI Crude Futures - Bulls Are Attempting to Reverse

rhboskres

Publish date: Fri, 20 Sep 2019, 04:53 PM

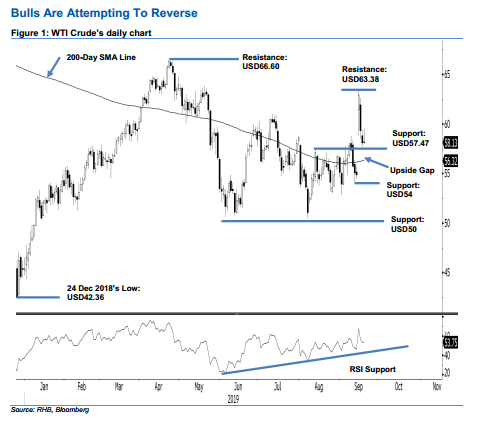

Maintain long positions until further adverse price actions develop. The WTI Crude settled the latest session marginally higher by USD0.02 at USD58.13. This was as it failed to hold on to most of its intraday gains, the high was recorded at USD59.54. Despite the marginally positive closing, the latest session can be seen as a possible rebound from the immediate support of USD57.47, which the commodity came near to test in the prior session. For now, provided the trailing-stop of USD57.10 for our ongoing long positions is not breached, we would keep to our positive trading bias.

As the bulls are still showing signs of control over the price trend, we continue to recommend traders stay in long positions. We initiated these at USD57.10, or the closing level of 13 Aug. For risk-management purposes, a stop loss can now be placed at the breakeven mark.

Immediate support is expected at USD57.47, which was the high of 13 Aug. This is followed by USD54, the low of 12 Sep. On the other hand, immediate resistance is pegged at USD63.38, the high of 16 Sep. This is to be followed by USD66.60, which was the high of 23 Apr.

Source: RHB Securities Research - 20 Sept 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024