FCPO - Possible Price Rejection

rhboskres

Publish date: Fri, 20 Sep 2019, 04:56 PM

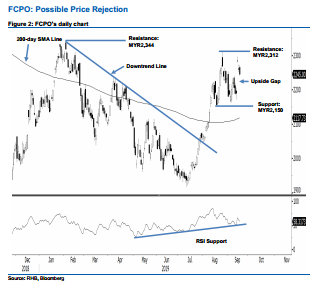

Initiate short positions on possible price rejection from the MYR2,300 level. The FCPO ended the latest session MYR15 weaker to close at MYR2,245. Trading range was between MYR2,240 and MYR2,272. The second consecutive weak session came in after the commodity close to test the MYR2,300 level on 17 Sep (which was the second attempt since 26 Aug). As the commodity reacted negatively from the said level in its second attempt, chances are high that there is a price rejection. As such, we now see a possibility for the commodity to experience a correction phase. Switch our trading bias to negative.

Our previous long positions initiated at MYR2,256, the closing level of 22 Aug were closed out at breakeven in the latest session. On the bias that there is occurrence of a price rejection, we initiate short positions at the latest closing. To manage risks, a stop-loss can be placed at above MYR2,312.

The immediate support is still pegged at MYR2,150, ie the low of 20 Aug. This is followed by MYR2,100, near the 200- day SMA line. Meanwhile, the immediate resistance is now set at MYR2,312, which was the high of 26 Aug. This is followed by MYR2,344, or the high of 7 Feb.

Source: RHB Securities Research - 20 Sept 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024