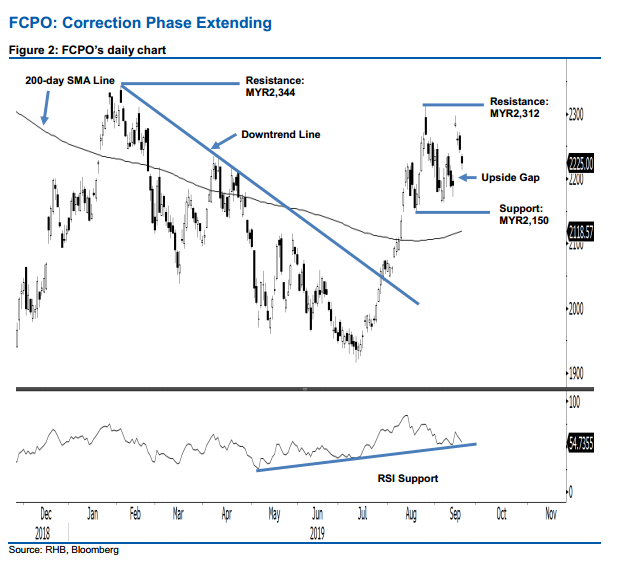

FCPO - Correction Phase Extending

rhboskres

Publish date: Mon, 23 Sep 2019, 03:21 PM

Maintain short positions as the bears have the upper hand. The FCPO continued to extend its sliding mode for the third consecutive session. At the closing, the commodity shed MYR20 to MYR2,225 – the low and high were posted at MYR2,214 and MYR2,238. Overall, it is still showing signs of extending its retracement. This came after it experienced a price rejection from the MYR2,300 level recently. Towards the downside, at the minimum, we are expecting the immediate support of MYR2,150 to be tested. Maintain our negative trading bias. On the observation that the bears are still in control of the price trend, we continue to recommend that traders stay in short positions. These were initiated at MYR2,245, which was the closing level of 19 Sep. To manage risks, a stop-loss can be placed above MYR2,312. We are keeping the immediate support target at MYR2,150, ie the low of 20 Aug. This is followed by MYR2,100, near the 200-day SMA line. On the other hand, the immediate resistance is expected to emerge at MYR2,312, which was the high of 26 Aug. This is followed by MYR2,344, or the high of 7 Feb.

Source: RHB Securities Research - 30 Sept 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024