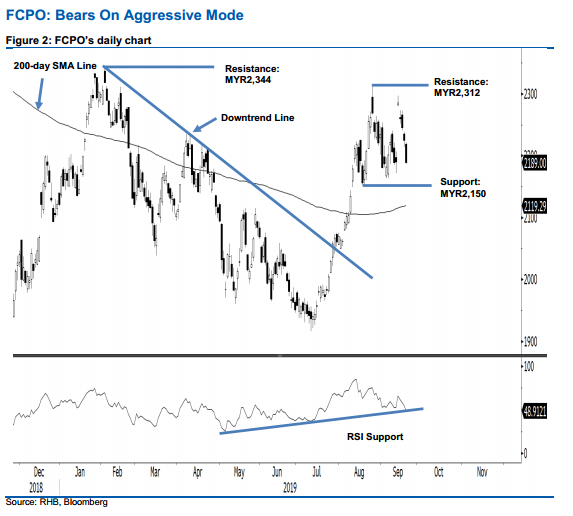

FCPO - Bears On Aggressive Mode

rhboskres

Publish date: Tue, 24 Sep 2019, 03:02 PM

Maintain short positions as the correction phase is still progressing. The FCPO continued to trade on soft ground, extending its weak closing for the fourth consecutive session. The low and high were recorded at MYR2,187 and MYR2,221, before closing at MYR2,189, a decline of MYR36. Overall, the commodity’s correction phase that resumed after the second failed attempt to cross the MYR2,300 level on 17 Sep is still progressing. Towards the downside, at the minimum, we are expecting the immediate support of MYR2,150 to be tested. Hence, we keep to our negative trading bias. As the correction phase is still progressing, we continue to recommend that traders stay in short positions. These were initiated at MYR2,245, which was the closing level of 19 Sep. To manage risks, a stop-loss can be placed above MYR2,312. The immediate support is pegged at MYR2,150, ie the low of 20 Aug. This is followed by MYR2,100, near the 200-day SMA line. Moving up, the immediate resistance is expected to emerge at MYR2,312, which was the high of 26 Aug. This is followed by MYR2,344, or the high of 7 Feb.

Source: RHB Securities Research - 30 Sept 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024