FKLI - Positive Follow-Up Needed

rhboskres

Publish date: Wed, 25 Sep 2019, 04:57 PM

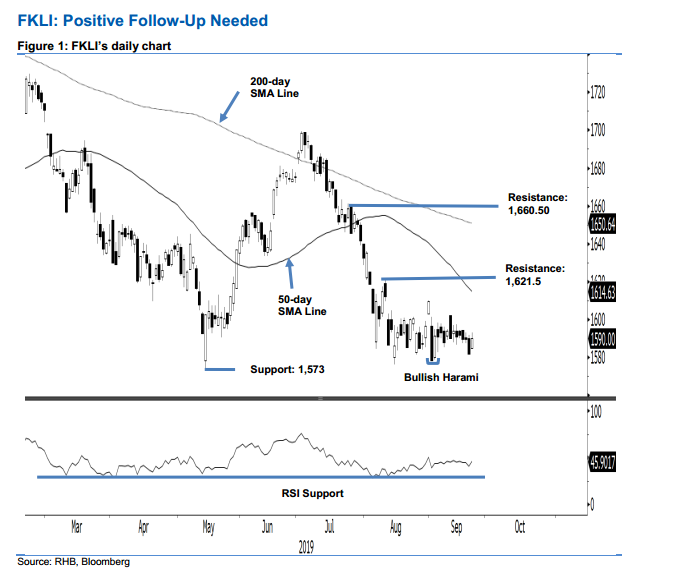

Still awaiting for reversal signal; maintain short positions. The FKLI ended the latest session on a positive note. At the closing, the index gained 8 pts to reach 1,590 pts, with the low and high at 1,584.5 pts and 1,593 pts. Still the positive session did not produce the required price signal (upside breach of the 1,600-pt level) to confirm the 4 Sep’s “Bullish Harami” formation. This is necessary to suggest that the index is ready to stage a stronger rebound. As such, we still consider the weak trend as still firmly in place. Maintain our negative trading bias. As the index’s movement since mid-August is still showing the characteristics of a sideways consolidation phase ie no reversal signal, traders are recommended to stay in short positions. We initiated these at 1,668 pts, or the closing level of 12 Jul. To manage risks, a stop-loss can now be placed above the 1,600-pt mark. Towards the downside, the immediate support is pegged at 1,573 pts, ie the low of 14 May. This is followed by the 1,550-pt mark. On the other hand, the immediate resistance is eyed at 1,621.5 pts, or the high of 9 Aug. This is followed by the 1,660.5-pt mark, ie the high of 24 Jul.

Source: RHB Securities Research - 25 Sept 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024