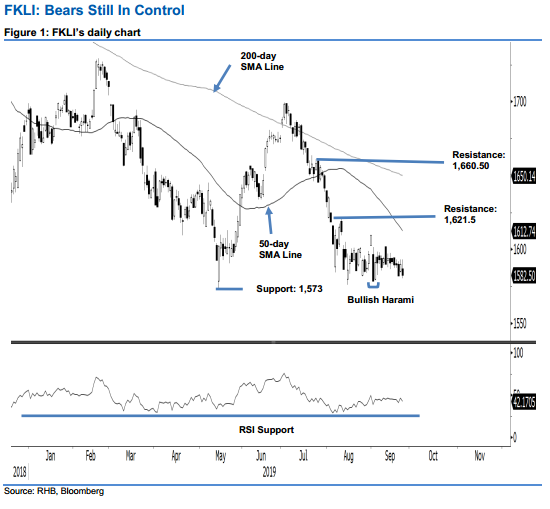

FKLI - Bears Still in Control

rhboskres

Publish date: Thu, 26 Sep 2019, 04:51 PM

No end to the bearish bias yet; maintain short positions. The FKLI slipped 7.5 pts in the latest session. It experienced a weak intraday trading tone as it generally trended lower for the whole session – the high and low were recorded at 1,593 pts and 1,580.5 pts. This suggests that the index’s weak trend, which resumed on the failed attempt to cross the 1,700-pt level on 2 Jul, is still firmly in place. It is further supported by the fact that both the 200-day and 50-day SMA lines continue to trend lower. Maintain our negative trading bias. As the index is still unable to confirm the 4 Sep’s “Bullish Harami” formation, traders are recommended to stay in short positions. We initiated these at 1,668 pts, or the closing level of 12 Jul. To manage risks, a stop-loss can now be placed above the 1,600-pt mark. We are keeping the immediate support target at 1,573 pts, ie the low of 14 May. This is followed by the 1,550-pt mark. Moving up, the immediate resistance is eyed at 1,621.5 pts, or the high of 9 Aug. This is followed by the 1,660.5-pt mark, ie the high of 24 Jul.

Source: RHB Securities Research - 26 Sept 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024