WTI Crude Futures: Tightening-Up Stop-Loss

rhboskres

Publish date: Mon, 30 Sep 2019, 09:14 AM

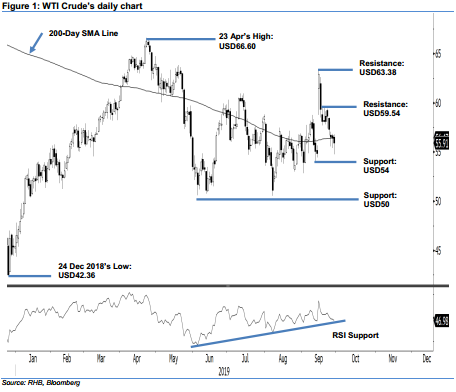

Maintain short positions while keeping risk management tighter. The WTI Crude managed to recoup a substantial part of its intraday losses to settle USD0.50 lower at USD55.91. The low was posted at USD54.75. The closing level placed the commodity marginally below the 200-day SMA line, which is a level the commodity has been struggling to overcome in the recent months. Overall, the commodity’s weak bias, which resumed from the high of USD63.38, is still showing signs of progressing. Maintain our negative trading bias.

As the commodity has fallen back below the 200-day SMA line, traders are advised to stay in short positions. We initiated these at USD56.49, the closing level of 25 Sep. For risk-management purposes, a stop loss can now be placed at the breakeven level.

Immediate support is pegged at USD54, the low of 12 Sep. This is followed by USD50, a round figure. Moving up, immediate resistance is now expected at USD59.54, the high of 19 Sep. This is followed by USD63.38, the high of 16 Sep.

Source: RHB Securities Research - 30 Sept 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024