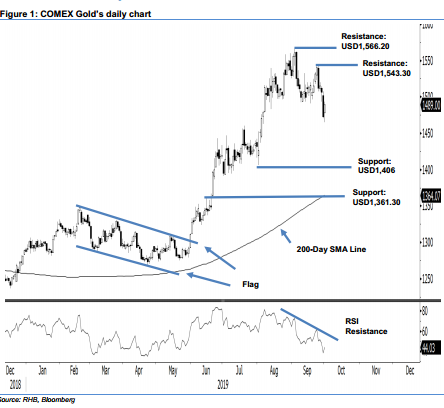

COMEX Gold: Correction Phase Stays Intact

rhboskres

Publish date: Wed, 02 Oct 2019, 09:51 AM

Maintain short positions as there is no clear price reversal signal. The COMEX Gold staged an intraday comeback to close USD16.10 higher at USD1,489. This was after it hit a low of USD1,465. Despite the encouraging intraday reversal, it is still insufficient to signal the commodity‘s multi-week correction, which resumed from the high of USD1,566.20 on 4 Sep, has reached an end. Its RSI reading is also indicating the correction phase has yet to reach an overbought condition. Hence, we are keeping our negative trading bias.

As we have yet to see conclusive evidence that the correction has run out of steam, we recommend traders stay in short positions. These were initiated at USD1,511.10, which was the closing level of 9 Sep. For risk-management purposes, a stop loss can now be placed at the breakeven level.

We are keeping the immediate support at the USD1,406 mark, which was near the low of 1 Aug. This is followed by USD1,361.30, the low of 20 Jun (also located near the 200-day SMA line). Conversely, the immediate resistance is set to emerge at USD1,543.30, the high of 24 Sep. This is followed by USD1,566.20, which was the high of 4 Sep.

Source: RHB Securities Research - 2 Oct 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024