E-mini Dow Futures: “Long Black Day” Candlestick Emerges

rhboskres

Publish date: Wed, 02 Oct 2019, 10:00 AM

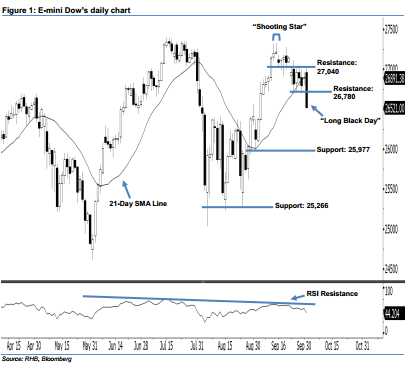

Initiate short positions below the 26,780-pt level. The E-mini Dow formed a “Long Black Day” candle last night. It lost 380 pts to close at 26,521 pts, off the session’s high of 27,040 pts. On a technical basis, as the index has taken out the previously-indicated 26,560-pt support and hit nearly a 1-month low, this indicates that market sentiment is turning negative. Furthermore, the 14-day RSI indicator slid below the 50 neutral point to flash a bearish reading at 44.20 pts, this implies a possibility that the downside move would keep going. Yesterday’s closing also triggered our previous trailing-stop recommendation at the 26,560-pt threshold – which has locked in part of the profit. Note we initially advised traders to initiate long above the 26,035-pt level on 9 Aug.

Presently, the immediate resistance level is seen at 26,780 pts, set near the midpoint of 1 Oct’s “Long Black Day” candle. Meanwhile, the next resistance is anticipated at 27,040 pts, near the highs of 23 Sep, 26 Sep, and 1 Oct. On the other hand, we are eyeing the immediate support level at 25,977 pts, ie the low of 3 Sep. If a breakdown occurs, the next support is situated at 25,266 pts, obtained from the previous low of 26 Aug.

Thus, we advise traders to initiate fresh short positions below the 26,780-pt level. In the meantime, a stop-loss is advisable to set above the 27,040-pt threshold in order to limit the risk per trade.

Source: RHB Securities Research - 2 Oct 2019