Hang Seng Index Futures: Downside Swing Stays Intact

rhboskres

Publish date: Wed, 02 Oct 2019, 10:04 AM

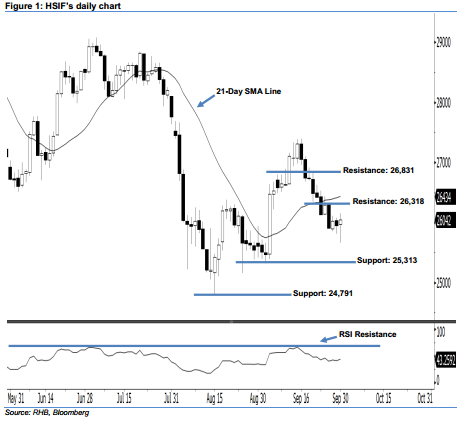

Initiate short positions below the 26,318-pt level. The HSIF formed a positive candle on Monday. It settled at 26,042 pts, after oscillating between a high of 26,158 pts and low of 25,656 pts. However, from a technical perspective, we believe the market sentiment has turned negative, given that the index has recently closed below the 21-day SMA line and the 26,000-pt support mentioned previously. The market decline lately can also be viewed as a continuation of sellers extending the downside swing from 16 Sep’s black candle. Meanwhile, 25 Sep’s black candle has also triggered our trailing-stop, which we had previously recommended that investors set at the 26,000-pt mark.

As seen in the chart, we are now eyeing the immediate resistance level at 26,318 pts, ie 25 Sep’s high. The next resistance would likely be at 26,831 pts, determined from the high of 19 Sep’s black candle. To the downside, the immediate support level is seen at 25,313 pts, situated at the low of 3 Sep. If this level is taken out, look to 24,791 pts – which was the previous low of 15 Aug – as the next support.

Hence, we advise traders to initiate short positions below the 26,318-pt level. A stop-loss can be set above the 26,831-pt threshold in order to minimise the risk per trade.

Source: RHB Securities Research - 2 Oct 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024