COMEX Gold - Bearish Bias Stays

rhboskres

Publish date: Fri, 27 Sep 2019, 05:04 PM

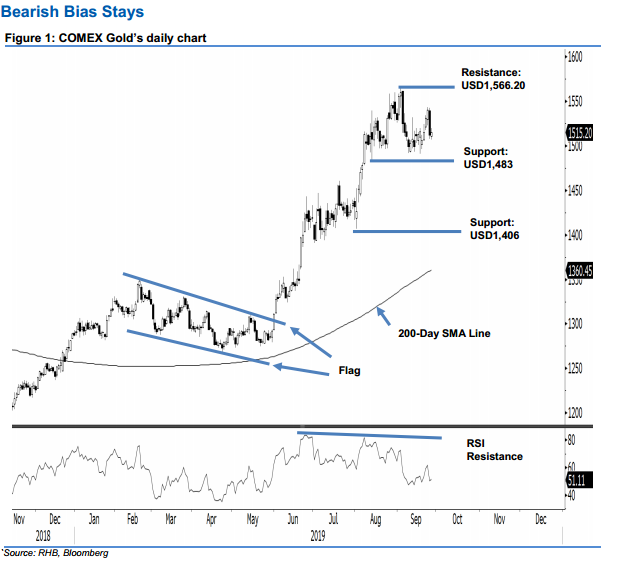

Maintain short positions as correction is still likely to extend. The COMEX Gold ended the latest session marginally higher by USD2.90 at USD1,515.20. This came after it reached a low and high of USD1,507.10 and USD1,519.50. However, the positive showing did not alter the commodity’s overall weak bias. It can be seen as just a minor pause after the prior session’s steep decline. We continue to expect the ongoing correction phase that started from the high of USD1,566.20 to, at the minimum, test the immediate support of USD1,483. Maintain our negative trading bias.

On the basis that the correction phase is still incomplete, we recommend traders stay in short positions. These were initiated at USD1,511.10, which was the closing level of 9 Sep. For risk-management purposes, a stop loss can be placed above USD1,566.20.

Immediate support is pegged at USD1,483, or the low of 13 Aug. This is followed by the USD1,406 mark, which was near the low of 1 Aug. Conversely, the immediate resistance is set at USD1,566.20, which was the high of 4 Sep. This is followed by the USD1,600 threshold

Source: RHB Securities Research - 27 Sept 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024