Hang Seng Index Futures - Trading Below 1-Year Downtrend Line

rhboskres

Publish date: Tue, 08 Oct 2019, 10:08 AM

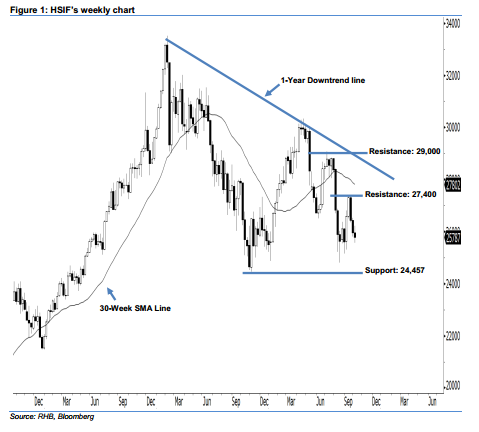

Market retracement will likely continue. Today, we analyse the HSIF’s longer-term trend. Based on the weekly chart, we think the market trend is considered bearish. This is because the index is trading below the 1-year downtrend line drawn in the chart. This line consists of the highs of 2 Feb 2018, 12 Apr, and 10 May. In addition, the HSIF remains below the declining 30-week SMA line, which means the bearish sentiment has been enhanced. That said, this sentiment is likely to remain unchanged, as long as prices are still holding below the aforementioned downtrend line.

According to the weekly chart, the immediate resistance level is seen at 27,400 pts, situated near the high of 16 Sep. The next resistance is anticipated at the 29,000-pt round figure, which is attached near the downtrend line as well. To the downside, we are eyeing the immediate support level at 24,457 pts, determined from the lowest point in 2018. Meanwhile, the next support will likely be at the 24,000-pt psychological spot.

Overall, we advise traders to stick to short positions, as signs of a significant rebound have not emerged yet. For more details, please refer to our 7 Oct report.

Source: RHB Securities Research - 8 Oct 2019