Hang Seng Index Futures - Downside Move Continues

rhboskres

Publish date: Thu, 10 Oct 2019, 05:34 PM

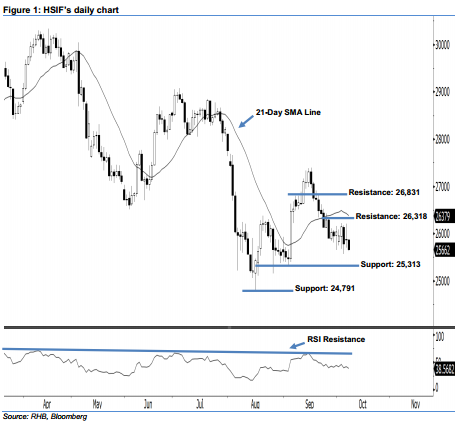

Stay short, with a new trailing stop set above the 26,318-pt level. The HSIF ended lower to form a black candle yesterday, pointing to a continuation of the downside move. It closed at 25,662 pts, off its high of 25,882 pts. Technically, we expect the downside swing, which started from 16 Sep’s black candle, is likely continue. This is because the index has stayed below the 21-day SMA line and previously indicated 26,318-pt resistance, implying that market sentiment is negative. Overall, we keep our bearish view on the HSIF’s outlook.

According to the daily chart, the immediate resistance level is maintained at 26,318 pts – this is situated at the high of 25 Sep’s long black candle. The next resistance will likely be at 26,831 pts, which was defined from 19 Sep’s high. On the other hand, we anticipate the immediate support level at 25,313 pts, ie the low of 3 Sep. Meanwhile, the next support is seen at 24,791 pts, which was the previous low of 15 Aug.

Hence, we advise traders to stay short, in line with our initial recommendation to have short positions below the 26,318-pt level on 2 Oct. For now, a new trailing stop can be set above the 26,318-pt threshold as well to minimise the risk per trade.

Source: RHB Securities Research - 10 Oct 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024