E Mini Dow Futures - Eyeing the Resistance at 26,617 Pts

rhboskres

Publish date: Fri, 11 Oct 2019, 04:51 PM

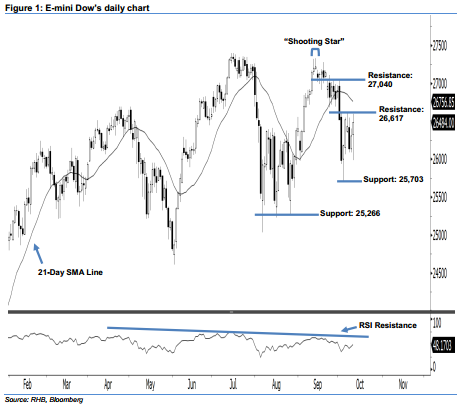

Stay short, provided the 26,617-pt resistance is not violated at the closing. The E-mini Dow ended higher to form another white candle last night. It rose 179 pts to close at 26,484 pts, off the session’s low of 25,983 pts. Still, the appearance of the 9-10 Oct white candles indicates bargain-hunting activities following the recent losses. On a technical basis, the bearish sentiment stays intact. This is as long as the index does not close above the 26,617-pt resistance mentioned a week ago. Overall, we believe that the downside swing – which started from 13 Sep’s “Shooting Star” pattern – may persist.

As seen in the daily chart, the immediate resistance level is maintained at 26,617 pts, ie the high of 2 Oct’s long black candle. If a decisive breakout occurs, the next resistance is anticipated at 27,040 pts, which was near the highs of 23 Sep, 26 Sep, and 1 Oct. To the downside, we are eyeing the immediate support level at 25,703 pts, ie the previous low of 3 Oct. Meanwhile, the next support will likely be at 25,266 pts, situated at the low of 26 Aug.

ence, we advise traders to stay short, in line with our initial recommendation to have short positions below the 26,780-pt level on 2 Oct. A trailing stop above the 26,617-pt threshold is advisable to minimise the risk per trade.

Source: RHB Securities Research - 11 Oct 2019