WTI Crude Futures - Stronger Rebound May be Developing

rhboskres

Publish date: Fri, 11 Oct 2019, 04:54 PM

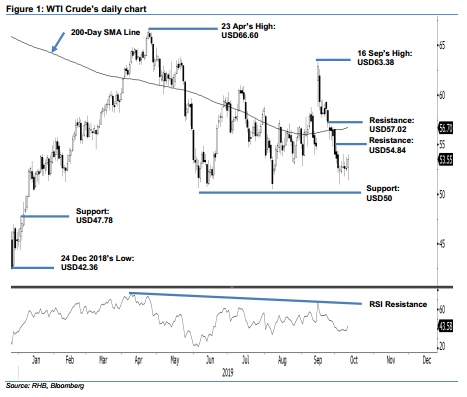

Initiate long positions as the bulls signal a possible stronger rebound. The WTI Crude traded in a relatively wide range, which saw it reversing its earlier session’s weak tone to close USD0.96 stronger at USD53.55. The low and high were posted at USD51.38 and USD53.97. The crossing of the USD53.00 mark, in our view, signals that the retracement that started from the high of USD63.38 on 16 Sep has reached an end, and that a stronger rebound may be developing. This came after the said retracement pushed the commodity to test the USD50.00 support level on 3 Oct. We switch our trading bias to positive.

Our previous long positions initiated at USD56.49, which was the closing level of 25 Sep, were closed out at USD53.00 in the latest session. On the expectation that the bulls are ready to engineer a stronger rebound, we initiate long positions at the latest closing. For risk-management purposes, a stop loss can be placed below the USD50.00 mark.

The immediate support is still pegged at USD50.00, a round figure. This is followed by USD47.78, which was the high of 2 Jan. Meanwhile, the immediate resistance is still pegged at USD54.84, or the high of 1 Oct. This is followed by USD57.02, ie the high of 25 Sep.

Source: RHB Securities Research - 11 Oct 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024