Hang Seng Index Futures - a Weak Recovery

rhboskres

Publish date: Fri, 11 Oct 2019, 04:57 PM

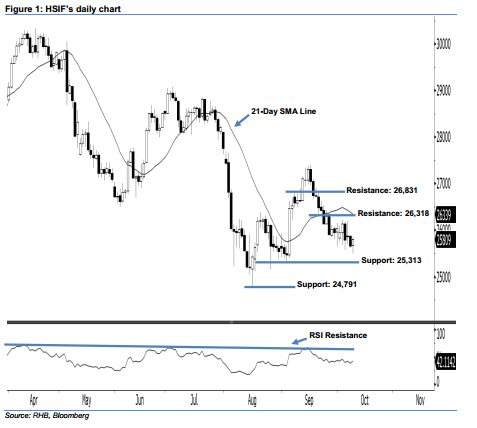

Maintain short positions. The HSIF posted a white candle yesterday. It closed at 25,809 pts, after oscillating between a high of 25,843 pts and low of 25,507 pts. The market sentiment remains negative as the index has continued to stay below the 21-day SMA line. From a technical perspective, as long as the index does not break above the 21-day SMA line and the 26,318-pt resistance mentioned two weeks ago, there is a possibility that the downside move will persist. Overall, we remain bearish on the HSIF’s outlook.

Judging from the current outlook, we anticipate the immediate resistance level at 26,318 pts, ie the high of 25 Sep’s long black candle. The next resistance is seen at 26,831 pts, determined from the high of 19 Sep. Towards the downside, the immediate support level is seen at 25,313 pts, which was the low of 3 Sep. If this level is taken out, look to 24,791 pts – ie the previous low of 15 Aug – as the next support.

Hence, we advise traders to maintain short positions, given that we previously recommended initiating short below the 26,318-pt level on 2 Oct. In the meantime, a trailing stop set above the 26,318-pt mark is preferable to limit the risk per trade.

Source: RHB Securities Research - 11 Oct 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024