COMEX Gold - the Minor Consolidation Is Extending

rhboskres

Publish date: Mon, 14 Oct 2019, 09:11 AM

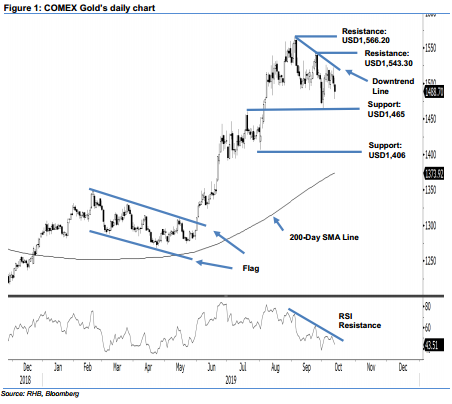

Maintain long positions, as the bulls are taking a pause. The COMEX gold ended the latest session below the USD1,500 level – a threshold the bulls have been defending over the past two weeks. The session’s low and high were recorded at USD1,478 and USD1,508, before closing USD12.20 weaker at USD1,488.70. Despite the failure to hold above the USD1,500 level, there were no firm price negative signals at this juncture, which could indicate that the commodity is at risk of experiencing a deeper retracement. Taken together, we are still of the view that the COMEX Gold is on its path towards extending its upward move. We maintain our positive trading bias.

As we still believe the bulls remain in control, we continue to recommend that traders stay in long positions – these were initiated at USD1,513.80, or the closing level of 3 Oct. For risk-management purposes, a stop loss can be placed below the USD1,465.00 threshold.

We are keeping the immediate support at USD1,465.00, which was the low of 1 Oct. This is followed by the USD1,406.00 mark, ie near the low of 1 Aug. Moving up, the immediate resistance is set at USD1,543.30, or the high of 24 Sep. This is followed by USD1,566.20, which was the high of 4 Sep.

Source: RHB Securities Research - 14 Oct 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024