E-mini Dow Futures - Long Position Triggered

rhboskres

Publish date: Wed, 16 Oct 2019, 05:34 PM

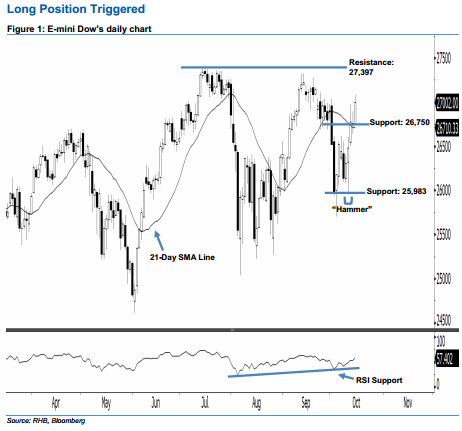

Initiate long positions above the 26,750-pt level. The E-mini Dow formed a white candle last night. It gained 256 pts to close at 27,002 pts, after oscillating between a high of 27,079 pts and low of 26,750 pts. Technically speaking, the index has recovered above the 21-day SMA line and the 27,000-pt threshold. This indicates that the market sentiment is turning positive. This can also be viewed as a continuation of the bulls extending the rebound from 10 Oct’s “Hammer” pattern. Meanwhile, 11 Oct’s closing has also triggered our trailing stop, which we had previously recommended that investors set at the 26,617-pt threshold.

Based on the daily chart, we now anticipate the immediate support level at 26,750 pts, ie 15 Oct’s low. If this level is taken out, look to 25,983 pts – which was the low of 10 Oct’s “Hammer” pattern – as the next support. Towards the upside, we are eyeing the immediate resistance level at the 27,397-pt historical high. The next resistance will likely be at the 28,000-pt psychological mark.

Thus, we advise traders to initiate fresh long positions above the 26,750-pt level. A stop-loss can be set below the 25,983-pt threshold to minimise downside risk.

Source: RHB Securities Research - 16 Oct 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024