Hang Seng Index Futures - Long Positions Now Activated

rhboskres

Publish date: Wed, 16 Oct 2019, 05:36 PM

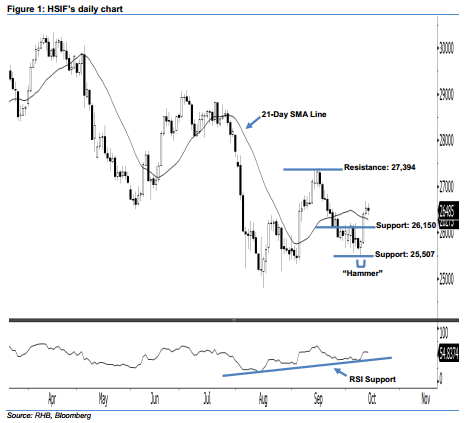

Initiate long positions above the 26,150-pt level. The HSIF formed a negative candle yesterday. It closed at 26,485 pts, off its high of 26,636 pts and low of 26,380 pts. Still, from a technical perspective, the index has recently climbed above the 21-day SMA line and hit its 3-week high, implying that the sentiment has turned positive. In addition, the 14-day RSI indicator rose above the 50 neutral point to flash a bullish reading at 54.83 pts – this has enhanced the positive sentiment. 11 Oct’s closing has also triggered our trailing stop, which we had previously recommended at the 26,318-pt threshold.

For now, we are eyeing the immediate support level at 26,150 pts, situated near the midpoint of 11 Oct’s long white candle. The crucial support is seen at 25,507 pts, ie the low of 10 Oct’s “Hammer” pattern. On the other hand, the immediate resistance level is anticipated at the 27,000-pt psychological spot. Meanwhile, the next resistance is seen at 27,394 pts, determined from the high of 16 Sep.

Hence, we advise traders to initiate long positions above the 26,150-pt level. In the meantime, a stop-loss set below the 25,507-pt threshold is advisable to minimise the downside risk.

Source: RHB Securities Research - 16 Oct 2019