WTI Crude Futures - Eyes Set on 200-Day SMA

rhboskres

Publish date: Fri, 18 Oct 2019, 09:22 AM

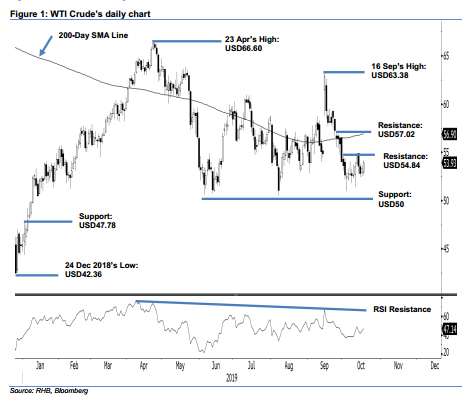

Maintain long positions as rebound is still progressing. The WTI Crude formed a white candle to settle the latest session USD0.57 stronger at USD53.93. Trading ranged between USD52.62 and USD54.16. We are maintaining our bias that the commodity’s two failed attempts to crack the USD54.84 immediate resistance level recently are not indicative of a possible negative price reversal. Instead, we still see it as just a minor pause in the rebound that started from an area near the USD50.00 immediate support level. Towards the upside, we are still targeting the bulls to challenge the 200-day SMA line.

Given that the bulls are still showing signs of control, we maintain our recommendation for traders to stay in long positions. We initiated these at USD53.55, which was the closing level of 10 Oct. For risk-management purposes, a stop loss can be placed below the USD50.00 mark.

Immediate support is pegged at USD50.00, a round figure. This is followed by USD47.78, which was the high of 2 Jan. Conversely, the immediate resistance level is expected to emerge at USD54.84, or the high of 1 Oct. This is followed by USD57.02, ie the high of 25 Sep.

Source: RHB Securities Research - 18 Oct 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024