WTI Crude Futures: Trading in the Rebound Phase

rhboskres

Publish date: Mon, 21 Oct 2019, 09:22 AM

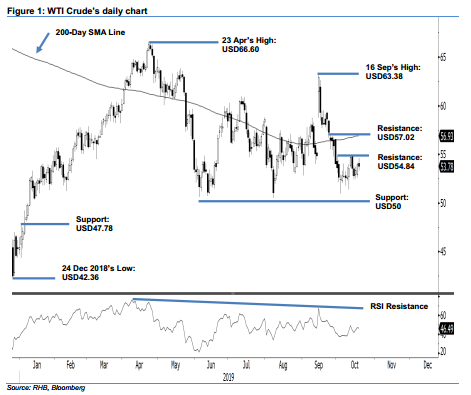

Tagging along the rebound; maintain long positions. The WTI Crude gave back its earlier session’s gains to settle slightly lower by USD0.15 at USD53.78. This was after it reached a high of USD54.62 – which is not far off from the immediate resistance of USD54.84. The black gold has attempted to break away from this immediate resistance twice over the past week. Price actions around this level over the coming sessions will be important. A firm breakout would likely to see the commodity reaching our minimum rebound target of retesting the 200-day SMA line. We maintain our positive trading bias.

As we are still expecting the bulls to push prices towards the 200-day SMA line in this rebound phase, we maintain our recommendation for traders to stay in long positions. We initiated these at USD53.55, which was the closing level of 10 Oct. For risk-management purposes, a stop loss can be placed below the USD50.00 mark.

Immediate support is set at USD50.00, a round figure. This is followed by USD47.78, which was the high of 2 Jan. Moving up, the immediate resistance level is expected to emerge at USD54.84, or the high of 1 Oct. This is followed by USD57.02, ie the high of 25 Sep.

Source: RHB Securities Research - 21 Oct 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024