FKLI & FCPO: FKLI: Sliding Back Below Resistance Zone

rhboskres

Publish date: Mon, 21 Oct 2019, 09:55 AM

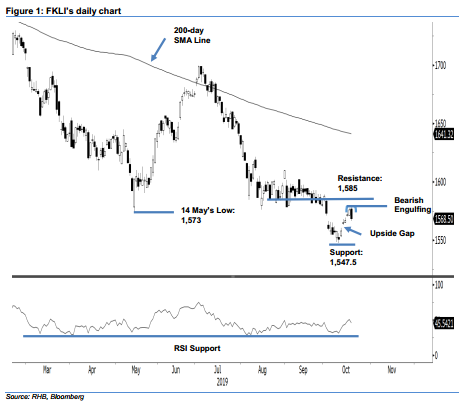

Maintain long positions. The FKLI closed on a weak note last Friday, falling below the resistance zone comprising 1,573 pts (14 May’s low) and 1,585 pts – and a “Bearish Engulfing” formation emerged. Trading ranged between 1,566.5 pts and 1,578.5 pts, before the index closed at 1,568.5 pts, indicating a decline of 7.5 pts. Despite falling below the resistance zone and the appearance of the negative candlestick formation, there is still not enough indication to suggest there is a price rejection from the resistance area – and that the countertrend rebound which started from the low of 1,547.5 pts has reached a peak. We maintain our positive trading bias.

As the index’s latest negative showing may only point to a pause by the bulls, we continue to recommend that traders stay in long positions. We initiated these at 1,565 pts, the closing level of 14 Oct. To manage risks, a stop-loss can be set below 1,547.5 pts.

The immediate support is expected at 1,547.5 pts, the low of 10 Oct, followed by 1,500 pts. Conversely, the immediate resistance is set at 1,585 pts, near the lower boundary of the sideways move that developed between mid-August and early-October. This is followed by the 1,600-pt mark.

Source: RHB Securities Research - 21 Oct 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024