E-mini Dow Futures - Still Positive

rhboskres

Publish date: Thu, 24 Oct 2019, 10:51 AM

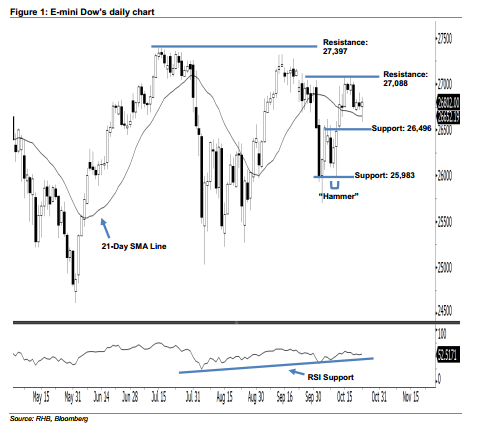

Positive sentiment remains unchanged, stay long. The E-mini Dow formed a positive candle with a long lower shadow last night, signalling that the sellers failed to reverse the bullish sentiment. During the intraday session, it plunged to a low of 26,588 pts before pushing up to 26,802 pts at the end of the session. This is a sign that the buying momentum remains intact. On a technical basis, at last night’s close, the index managed to register a higher close after testing the 21-day SMA line. This indicates that the E-mini Dow’s outlook remains bullish.

Presently, the immediate support level is anticipated at 26,496 pts – this was determined from 11 Oct’s low. Meanwhile, the next support is seen at 25,983 pts, ie the low of 10 Oct’s “Hammer” pattern. Towards the upside, the immediate resistance level is situated at 27,088 pts, which was the high of 17 Oct. If a breakout occurs, the next resistance is maintained at the 27,397-pt historical high.

Therefore, we advise traders to maintain long positions, in line with our initial recommendation to have long positions above the 26,750-pt level on 16 Oct. In the meantime, a stop-loss can be set below the 25,983-pt threshold to limit the risk per trade.

Source: RHB Securities Research - 24 Oct 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024