Hang Seng Index Futures - Long Positions Still in Play

rhboskres

Publish date: Thu, 24 Oct 2019, 10:53 AM

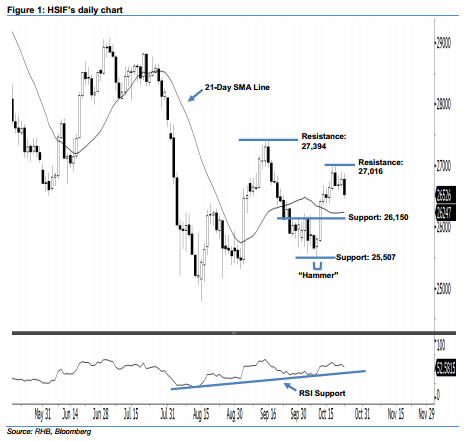

Stay long, with a stop-loss set below the 25,507-pt support. The HSIF ended lower to form a black candle yesterday. It settled at 26,526 pts, off the session’s high of 26,872 pts. Despite its lower close yesterday, the index is still trading above the 25,507-pt support mentioned previously, which indicates that the upside move has not diminished yet. Technically speaking, as the HSIF continues to stay above the 21-day SMA line, this also implies that the rebound from 10 Oct’s “Hammer” pattern remains valid. Overall, we stay positive on the index’s outlook.

As seen in the chart, we maintain the immediate support level at 26,150 pts, which is set near the midpoint of 11 Oct’s long white candle. The next support will likely be at 25,507 pts, or the low of 10 Oct’s “Hammer” pattern. Towards the upside, the immediate resistance level is seen at 27,016 pts, ie 18 Oct’s high. The next resistance is anticipated at 27,394 pts, which was obtained from 16 Sep’s high.

Hence, we advise traders to stay long, given that we initially recommended initiating long above the 26,150-pt level on 16 Oct. A stop-loss can be set below the 25,507-pt mark to minimise the downside risk.

Source: RHB Securities Research - 24 Oct 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024